Payment Settings

When you start building your webstore, you must think about how you are going to receive payments from your customers. Sana Commerce Cloud provides many options including integration with more than 20 payment service providers which allow your customers to pay online using credit and debit cards, on account payments and partial payments based on prepayment %.

There are some differences in how B2C and B2B customers can pay for their orders.

| B2C Customers | B2B Customers |

|---|---|

|

|

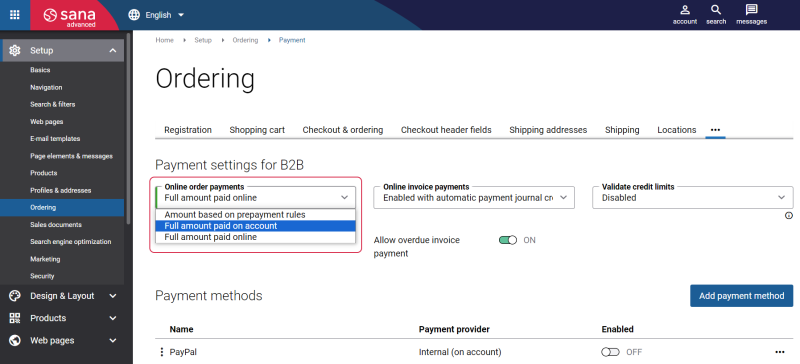

Online Order Payments

Only for B2B customers you can choose how they should pay their orders. That is because B2C customers always pay their orders online through a payment service provider using their credit or debit card. Unlike B2C customers, B2B customers can pay their orders on account, online using their credit or debit cards or based on prepayment % set for the customer in the ERP system.

Prepayments are only supported by Microsoft Dynamics NAV, Microsoft Dynamics 365 Business Central, SAP ERP and SAP Business One. If you have some other ERP system, you cannot use the payment type Amount based on prepayment rules.

Related Articles

Payment Types

Online Payments

On Account Payments

Prepayments

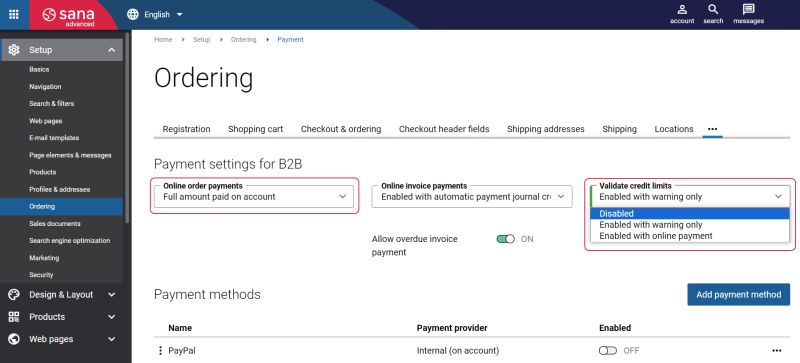

Validate Credit Limits

Credit limits validation can be enabled only for B2B customers in Sana Commerce Cloud.

As a webstore administrator, you can set up credit limits for your business customers in the ERP system. There might be some differences depending on the ERP system you are using and combination of settings Online order payments and Validate credit limits.

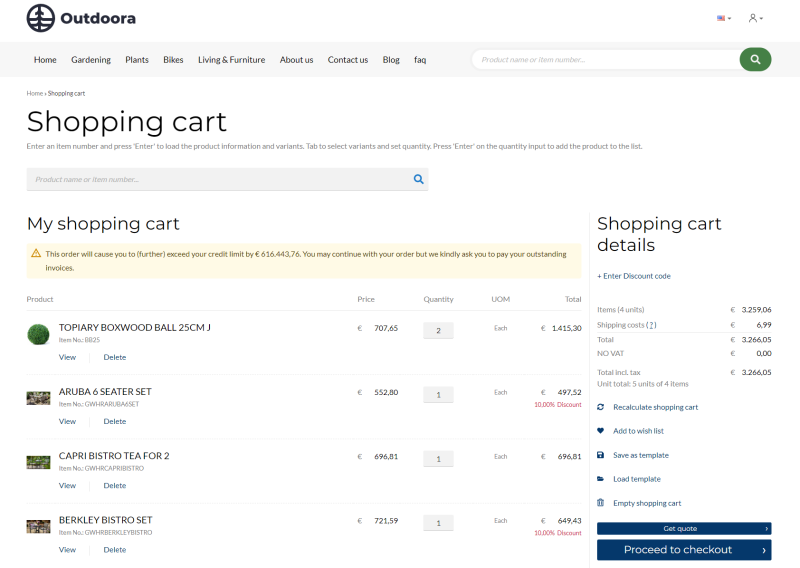

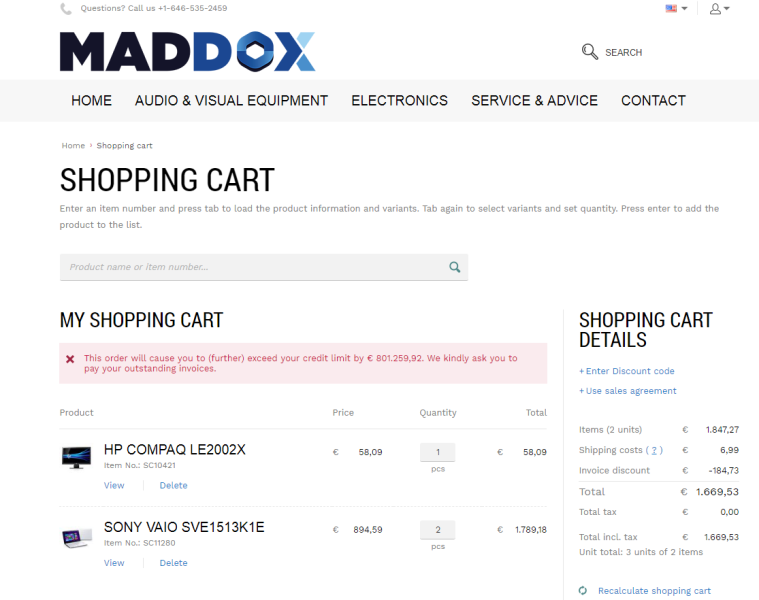

Using the option Validate credit limits, you can inform your business customers about exceeding their credit limit. The warning message is shown in the shopping cart and on all checkout steps.

The available options are:

-

Disabled: When business customers exceed their credit limit, the warning message will not be shown in the shopping cart. Customers go through the usual checkout process. If the credit limit is set for the customer in ERP and it is exceeded, it will be still calculated in your ERP system.

-

Enabled with warning only: A warning message is shown in the shopping cart, informing customers that their credit limit is exceeded and asking to pay the outstanding invoices. Customers can also see the amount by which they exceed the credit limit.

-

Enabled with online payment: A warning message is shown in the shopping cart, informing customers that their credit limit is exceeded and asking to pay full amount online through the payment provider. Customers can also see the amount by which they exceed the credit limit.

In some ERP systems you can forbid customers to place an order, if the credit limit is exceeded. In this case, the error message will be shown in the shopping cart, regardless of the selected option in the field Validate credit limits, informing customers that their credit limit is exceeded, and customers will not be able to proceed to checkout and complete the order.

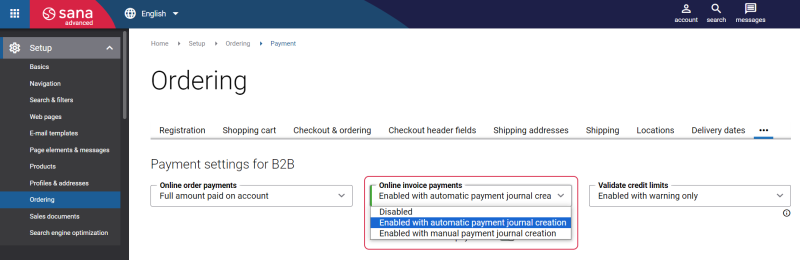

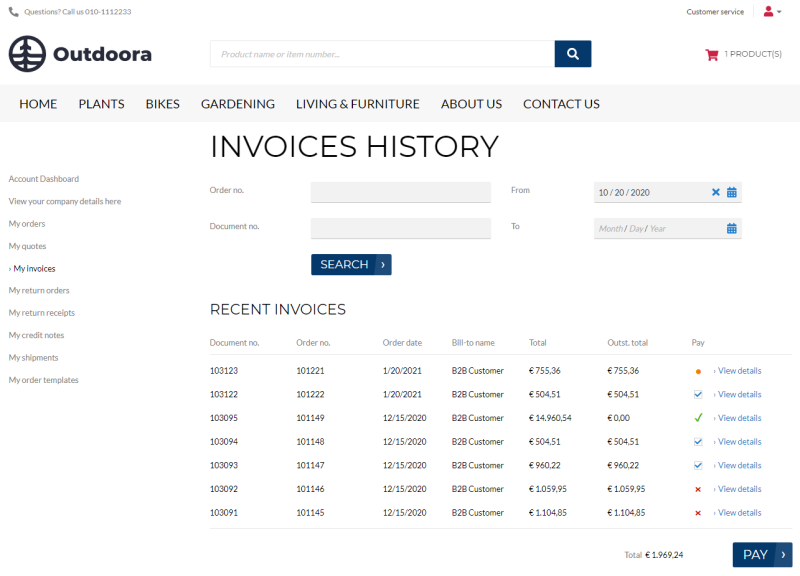

Online Invoice Payments

Only B2B customers can pay their outstanding invoices online from the My Account page.

Using this option, you can allow business (B2B) customers to pay their outstanding invoices online, either with the automatic payment journal creation in the ERP system or manual. To allow your B2B customers to pay their invoices online from the Sana webstore, you must also set up the necessary settings in your ERP system.

For more information, see Online Invoice Payments.