State Tax Areas

One of the important questions of running any business is sales taxes. Every company collects and pays taxes to various tax authorities. The rules and rates vary for countries, states, counties, and cities, and must be updated periodically as tax authorities change their requirements.

The tax area represents a combination of sales tax jurisdictions based on a particular geographic location. Tax areas together with other components, like tax jurisdictions, tax details and tax groups, are used to set up taxes.

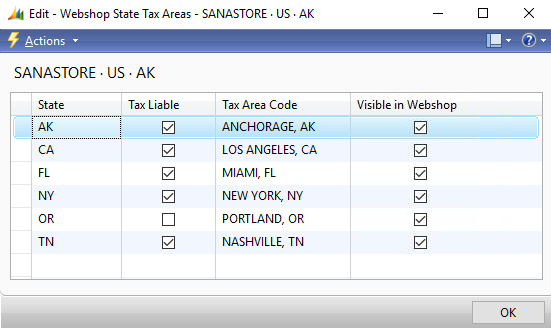

We extended the standard state tax area functionality in Microsoft Dynamics NAV. If you are doing your business in the country which has states, you can create a list of states and set up tax area code for each state.

State tax areas are mostly used to set up taxes for the USA, but you can also use this functionality for any other country which has states.

Set Up State Tax Area

Step 1: In Microsoft Dynamics NAV click: Departments > Webshop > Lists > Webshops. Select your webshop, and then click: Related Information > Webshop > Webshop Countries.

Step 2: Select the country which has states and click State Tax Area.

Step 3: In the State field, enter the correct state postal abbreviation. If you enter the incorrect value, then the tax for this state will not work. For example, if you need to set up tax for California, then use the CA state postal abbreviation in the State field.

Refer to the U.S Bureau of Labor Statistics website to see the correct state postal abbreviations for the USA.

Also, set up tax liability and enter tax area code. The taxes are calculated based on the entered tax area code.

Step 4: Use the Visible in Webshop checkbox to show and hide any state, region, county, etc. in the webshop.

When and How to Use Tax Area Codes?

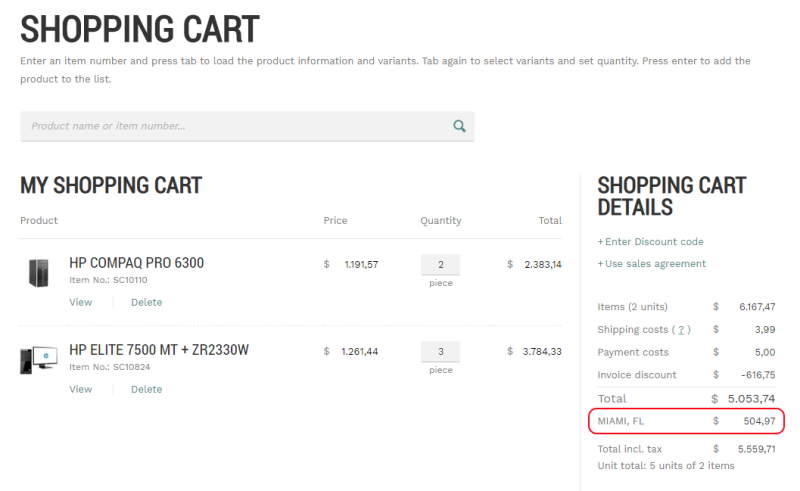

Tax area code can be set for a state, a customer template assigned to a country, a customer and customer’s shipping address. Depending on the situation, different tax area codes will be used based on priority to calculate taxes in the Sana webshop.

See how sales taxes are calculated based on the tax area codes in the Sana webshop in different scenarios.

Scenario 1

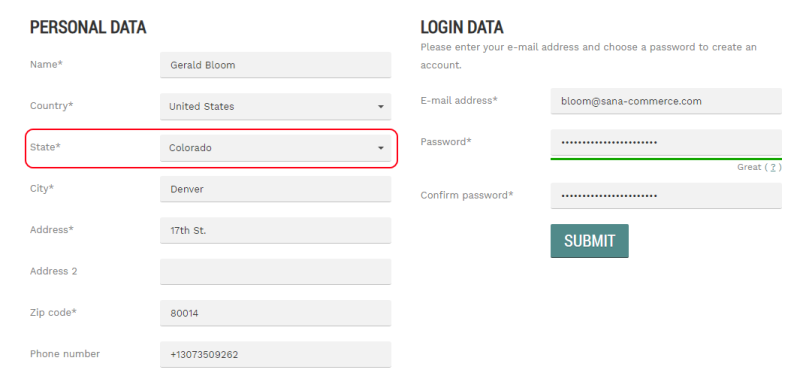

When a customer registers in the Sana webshop online, the tax area code set for a state in the Webshop Countries in Microsoft Dynamics NAV will be used and saved for this customer. The same tax area code will be used to calculate taxes when a customer places an order in the webshop.

If there is no tax area code set for the selected state, then when a customer registers in the Sana webshop online, the tax area code from a customer template assigned to a country will be used for a customer. This tax area code will be also used to calculate taxes, when a customer places an order in the webshop.

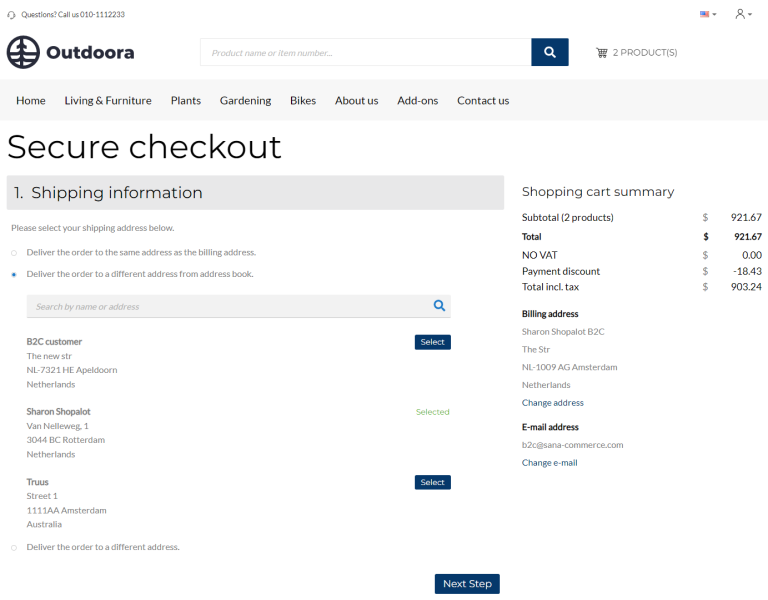

Scenario 2

When a customer places an order in the Sana webshop and selects the shipping address from the address book on the Shipping information checkout step, the tax area code for the selected shipping address will be used to calculate taxes. In case the Tax Liable option is not enabled for this shipping address in Microsoft Dynamics NAV, then the tax area code set on the Customer Card will be used instead.

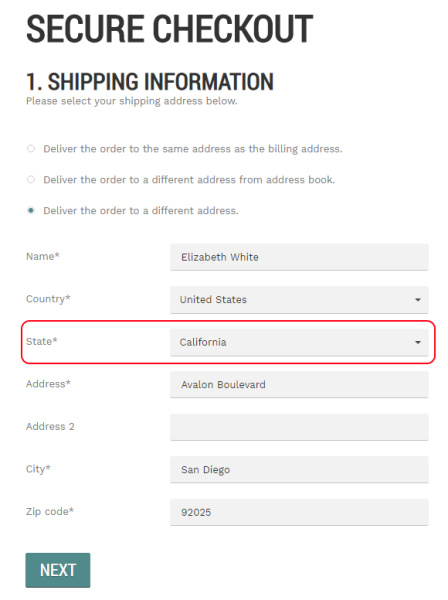

Scenario 3

When a customer places an order in the Sana webshop and enters a new shipping address on the Shipping information checkout step, the tax area code set in Microsoft Dynamics NAV for the selected state will be used to calculate taxes. If the tax area code is not set for a state, then the tax area code from a customer template assigned to a country will be used. In case tax area code is not set for a state or country, then the tax area code set on the customer card will be used to calculate taxes.

Related Articles

B2C Customer Registration

B2B Customer Registration

Customer Address

Countries