Authorisation Adjustment

Authorisation period renewal is available only in Sana Pay+ for Discover, Mastercard, Visa, and American Express.

Authorisation Period Renewal

When customers pay their orders with Sana Pay, Sana sends a payment authorisation request to Sana Pay. The authorisation process checks that the credit card is valid and that the card has enough funds for the transaction. When the payment is approved and authorised by Sana Pay, the payment amount is reserved but not yet deducted from the customer’s account. Then you can capture the payment.

Sana Pay expires an authorisation request automatically after 28 days from the day the payment is authorised for all major global card networks. A payment authorisation expires if the payment is not captured within the expiry period. When authorisation expires, it is no longer possible to capture the payment. The default expiry period can be adjusted and ensures that Sana Pay does not automatically expire the authorisation after the default 28 days.

Sana Pay checks if the sales order is still open (not invoiced or shipped) and adjusts the authorisation period, if necessary, when you run the Payment capture scheduled task.

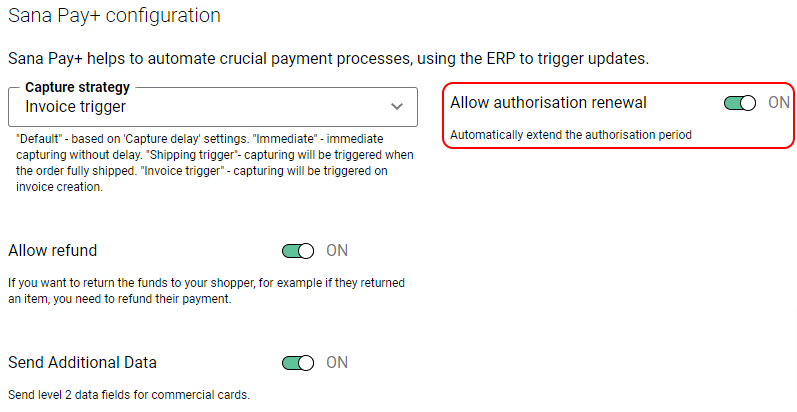

To allow Sana Pay to automatically extend the authorisation period, you must enable the option Allow authorization renewal for all Sana Pay payment methods that should support authorisation renewal. When the payment transaction is captured, no authorisation adjustment will be made.