Merchant Accounts

Merchant accounts are created and configured by Sana Commerce for you. Please, contact your Sana Commerce representative if you have any questions. For more information, see Installation and Configuration.

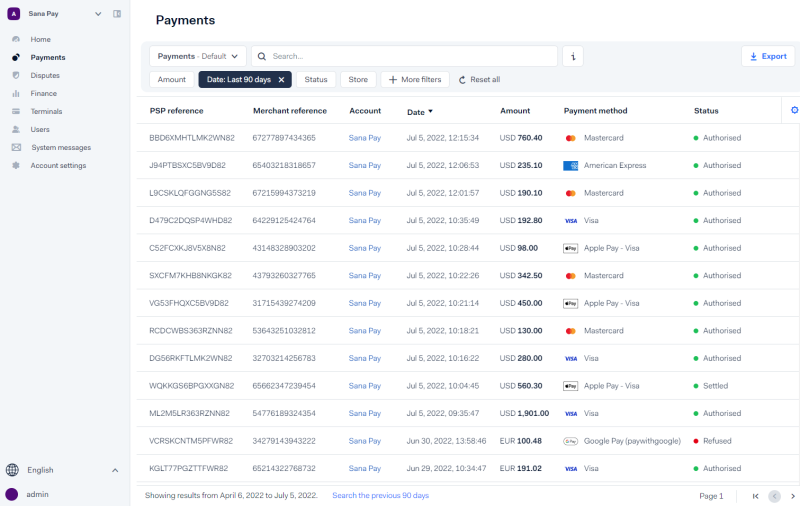

With Sana Pay, you have one or more merchant accounts. This is where all your payments are processed. The merchant account is where you receive your order or invoice payments. It is also where payment methods and processing currencies are configured.

Sana Pay supports multiple merchant accounts. This means that all your payment transactions can be processed for different merchant accounts. The number of merchant accounts you should have depends on your business. For many of our customers, it is enough to have a single merchant account. However, having multiple merchant accounts might be useful or even required in some cases. For example, if you are doing business in different countries and selling products to shoppers in Europe and the USA, you can have two merchant accounts for processing payments in Europe and the USA, respectively.

In general, we recommend that you have as few merchant accounts as possible, as long as you have enough to accommodate your business needs. Having fewer merchant accounts simplifies your operations and minimizes the number of reports you need for reconciliation. However, having more merchant accounts allows for increased granularity in reporting and how you get paid.

For more information, see Sana Pay Payout Bank Account.

Legal Entities

You need a separate merchant account for each legal entity that you process payments with. You cannot link a single merchant account to two legal entities, for example, one in the USA and another one in the Netherlands.

However, one legal entity can have multiple merchant accounts. For example, a legal entity in the USA can have multiple USA merchant accounts.

Invoicing

Every month, Sana Commerce will invoice you. You will receive one invoice per merchant account. The invoice will include all transaction fees associated with each individual merchant account.

Acquiring

Our merchants often open legal entities with us in regions where we offer local acquiring. This may provide several benefits such as reduced interchange and scheme fees, increased authorization rates, as well as faster settlement.

Your acquiring connections are configured at the merchant account level, and a single merchant account can be associated with only one acquiring region.

Getting Paid

Sana Pay pays out to you at the merchant account level. The more merchant accounts you have, the more payout batches you will receive.

Your merchant account must be associated with the legal entity that owns the bank account to which funds will ultimately be settled. If you are accepting payments in multiple currencies, you may link multiple bank accounts to a single merchant account.

Although you may have multiple bank accounts linked to your merchant account, you may only have one bank account per settlement currency. If you want to split funds from different countries in the same currency, you need to create multiple merchant accounts.

For more information, see Sana Pay Payout Bank Account.

Reporting

The reports used for reconciling bank settlements are generated at the merchant account level. You can choose to configure merchant accounts by individual business lines or geography, based on how you would like to receive this information.

Having fewer merchant accounts reduces the number of reports required for financial reconciliation, which is especially important to consider if you reconcile manually.

User Permissions

With Sana Pay, users can have access to all or only one merchant account. If you need to separate access for each merchant account, you need to create individual merchant accounts. Merchant admins can manage user access by adding new users or revoking access.

Merchant Account Setup

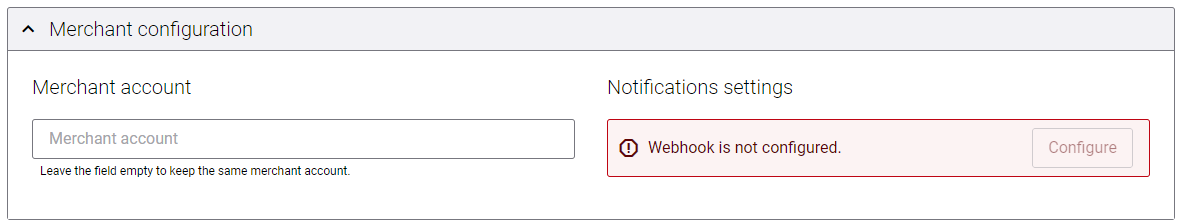

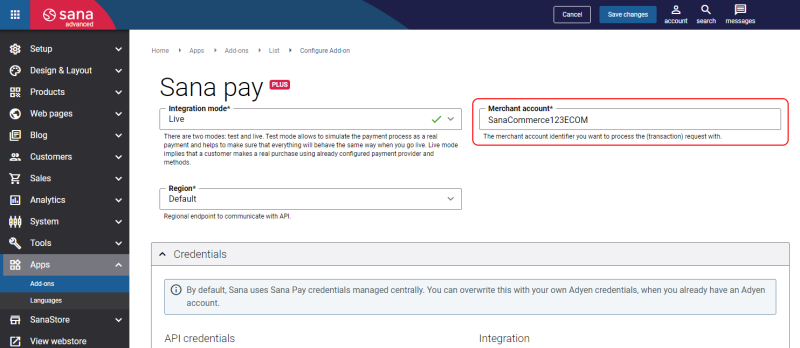

If you use only one merchant account in Sana Pay, it must be specified in the Sana Pay add-on settings.

If you want to use different merchant accounts for different payment methods, the necessary merchant account must be specified in the payment method settings of the Sana Pay payment provider.