How Do Payouts Work?

This article describes how payment transactions processed via Sana Pay end up in your payout.

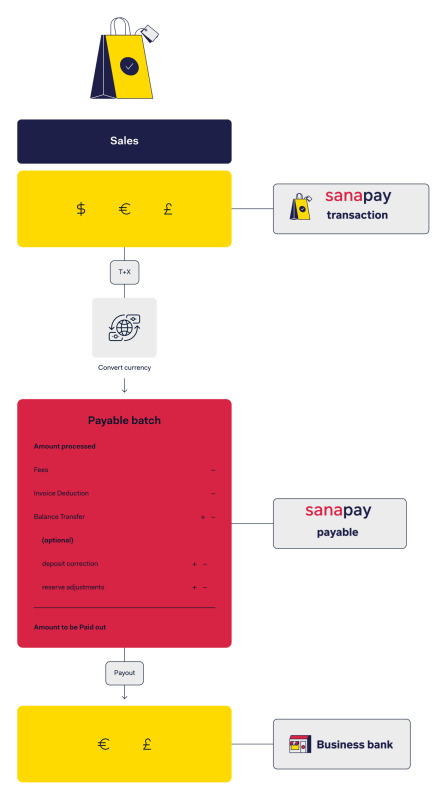

The funds for the transactions Sana Pay processes for you are assigned to a payable batch based on the Sales Day Payout (SDP) model. It allows you to receive funds based on a set schedule rather than being dependent on the timelines of card schemes and payment methods.

The payout frequency is by default on a daily basis, but it can be changed upon request. The frequency is limited to one of four options:

- Payout daily

- Payout once per week (every Tue)

- Payout monthly (every 15th)

- Payout monthly (every 1st)

You get all the funds from a particular sales day in a single payout batch, with a fixed payout delay. For example, if you have a T+2 Sales Day Payout, you would receive on Wednesday the sales from Monday.

It is important to note that SDP does not include the weekend. The delays are calculated based on working days.

The Sales Day Payout model provides:

- Payouts and reports based on total sales from a single day.

- Simplified reconciliation, because you can match a full day's payout with a full day's sales.

- Predictable cash flows, because you know which sales are paid each day.

The Payable balance has the most up-to-date information about the current payable batch. The payable batch closes according to the payout frequency determined in your payout model. If the Payable balance is positive when the payable batch closes, Sana Pay instructs the payout to you.

If you would like to reconcile your payout, you can use the Settlement Details report.

Sana Pay pays you on a net basis. This means your payable batch is made up from your sales figure from which we deduct:

- Transaction fees

- Refunds

- Chargebacks

- Other adjustments, for example, balance transfers

When the payable batch closes, we create a Settlement Details report. This report contains information on the transactions that were credited or debited to your account, including the costs associated with these transactions.

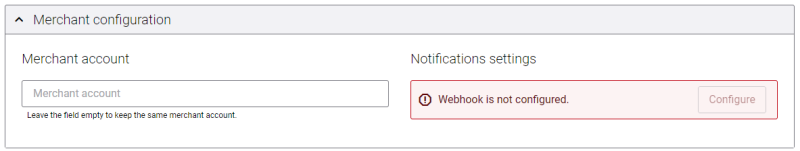

Sana Pay Payout Bank Account

Part of the Sana Pay onboarding process is setting up a payout bank account. Transactions that have been settled successfully will be paid on this account after the payout delay as determined by the KYC process. Each Sana Pay merchant account has at least one payout bank account. The bank account must correspond to the name of the audited entity. Multiple bank accounts can be configured for each merchant account for payouts in the transaction currency. The bank account name should also match the screened entity name owned by that legal entity. Sana Commerce Cloud can connect multiple Sana Pay merchant accounts to a single Sana Commerce webstore.

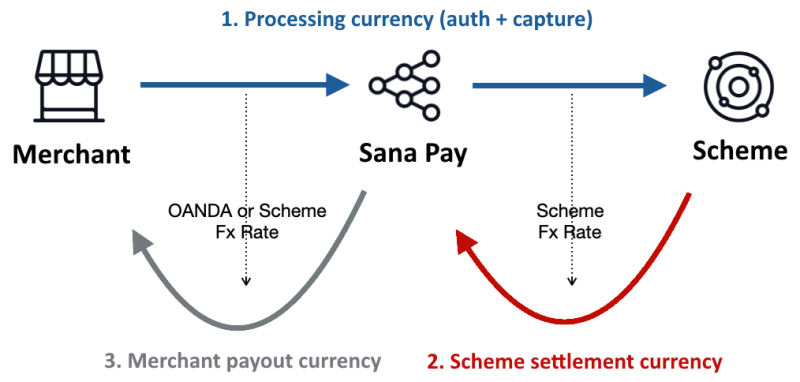

Sana Pay offers like-for-like (no currency conversion) settlement if the currency is also supported as a settlement currency by the payment method. All currencies for which you have not created a payout account will be settled in the primary settlement currency (the default currency). The like-for-like settlement means that no currency conversion will be applied by the scheme or by Sana Pay.

For merchants, like-for-like settlement is when 1 and 3 from the list below are the same currency. In this case, there is no currency conversion, and the merchant does not pay a forex markup to Sana Pay for processing the transaction. A true like-for-like settlement is when all three from the list below use the same currency and no currency conversion occurs.

- The processing currency, also known as transaction currency (used for authorization and capture).

- The settlement currency (payment from the scheme to Sana Pay).

- The merchant payout currency (payment from Sana Pay to merchant).

Example

A legal entity, Company X LLC., registered in Canada, sells products to Canada, USA, and Europe.

The default payout account will be linked to the Canadian bank account specified during KYC. Transactions in foreign currencies will be converted to the currency of the payout bank account (FX rate on the day of the transaction).

However, it is possible to receive payments in local currencies using additional payout accounts for these currencies:

- Bank accounts in different currencies under the same (screened) legal entity name (Company X LLC.). This may result in higher interchange fees due to cross-border transactions, for example, Canadian entity <-> European buyer.

- Payout bank account USD for USD transactions

- Payout bank account EUR for EUR transactions

- Payments in other currencies will be automatically made to the primary bank account (CAD) – the FX rate will be applied

-

Create new merchant accounts for local entities, for example, Company X Inc. and Company X GmbH with payout accounts in local currencies. This results in the best interchange fees but requires a separate KYC for these entities.

- New Entity USA (Inc.) and USD payout account

- New Entity Europe (GmbH) and EUR payout account

If other payout accounts are not registered to the same (screened) entity account, a separate merchant account with a different transaction flow can be registered for each payout account. Within one Sana Commerce Cloud environment, you can connect multiple Sana Pay merchant accounts.

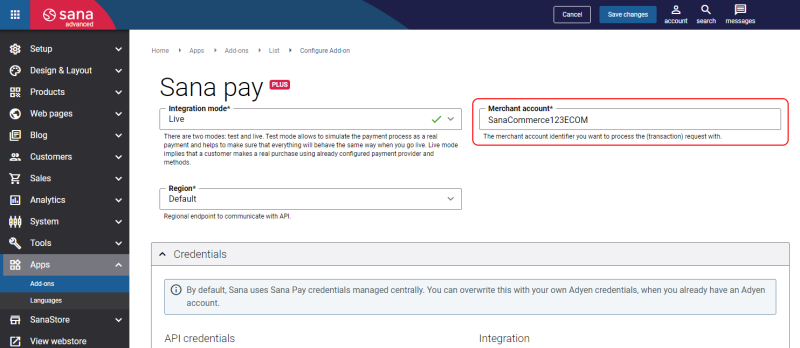

The Sana Pay add-on has default settings where you can specify a merchant account if you use one.

If you want to use different merchant accounts, they must be specified in the payment method settings.

For more information, see Merchant Accounts.

Sana Pay Exchange Rate

Sana Pay uses the exchange rate of the day that the payment is settled. At that moment, we charge the FX fee, which is 1.2% for the primary settlement currencies (USD, CAD, EUR, GBP, AUD) and 3% for other currencies. We use the daily midday rate from Oanda plus the markup.

Sana Pay Payout Delay

During the onboarding process, a payment schedule is established that fits your business needs. However, we know that circumstances can change and thus the payment schedule can be modified as described in the Terms & Conditions during the KYC onboarding process. For example, if more than 25% of the captured volume (volume payable) consists of payments that structurally settle later than the payout delay. Sana will always inform its customers in case of a change in the payout delay – both when increasing and decreasing the delay.

Sana Pay Deposit

For most of our customers, the potential losses on the Sana Pay account are covered by a payout delay – this is the so-called “merchant’s potential liability”, the calculated risk of not being able to pay back the exposure to the acquirer, for example, in case of bankruptcy. However, when a merchant has an increased potential exposure of potential losses on the Sana Pay account, and/or coverage is insufficient to cover those potential losses, an additional deposit may be held by Sana Pay. Deposits are also held to protect merchants from settlement uncertainties in extreme scenarios, for example, the COVID-19 pandemic. Having the necessary funds in place allows cash outflows to remain stable rather than blocking payments when unforeseen circumstances arise. As described in the processor's Terms & Conditions, a deposit can be held on the account in case additional exposure occurs, and once that exposure is reduced, the funds will be released again.