Tax Number Formats

Tax number is the unique number that identifies a taxable person or business that is registered for tax.

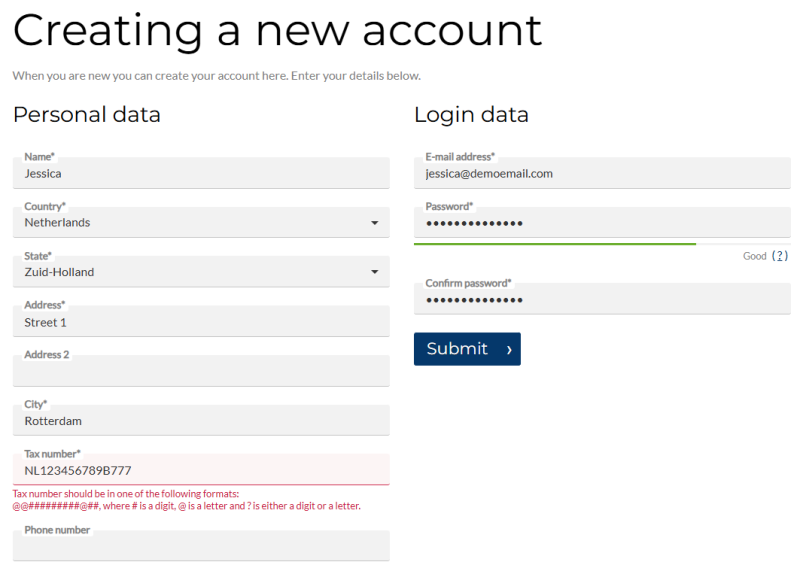

You can ask a customer to enter the tax number when:

- A customer registers in a Sana webshop.

- A customer creates an order as a guest without registration.

- A sales agent creates a prospect.

By default, SAP ECC provides predefined tax number formats for certain countries. Usually, these standard tax formats validate only the length of the tax number (the number of characters).

Sana Commerce Cloud provides its own more flexible functionality for tax number formats. In SAP ECC, you can set up tax number formats to ensure that a number entered by a customer corresponds to the standard format used in a country. Tax numbers are automatically validated against the correct format based on the selected country.

- If tax formats are configured in the Webstore Configuration window, these settings have higher priority and are used for validation.

- If no tax formats are configured for a webstore, SAP ECC checks its standard tax formats.

Key Benefits

- Ensures accuracy of tax number entries, reducing errors.

- Saves time for both customers and merchants by catching formatting issues early.

- Supports compliance with local tax regulations.

- Improves data quality in SAP ECC, enabling smoother order processing and invoicing.

Country-specific tax number formats enhance customer experience and streamline financial operations for accountants, making tax-related workflows more reliable and efficient.

Set Up Tax Number Format

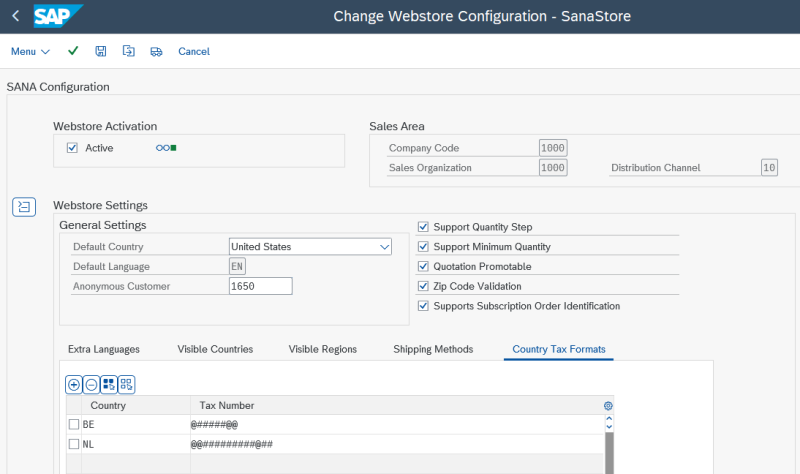

Step 1: In the main menu of the Sana add-on in SAP ECC (/n/sanaecom/webstore), click Webstore Configuration.

Step 2: In the Webstore Id field, select your webstore and click on the Change Webstore Settings button at the top.

Step 3: Expand the Webstore Settings area.

Step 4: In the Country Tax Formats table, specify the tax number format for a country. Each country can have only one defined tax number format.

The following symbols can be used to specify the tax number format for a country:

- "#" – only a digit can be entered

- "@" – only a letter can be entered (a-z or A-Z)

- "?" – either a digit or a letter can be entered

You can use other symbols such as dashes, dots, or slashes in the tax format if they are present in the country tax number format. Any character in the tax number format must exactly match the corresponding character in the tax number. This ensures that only valid tax numbers that match the specified tax number format are accepted.

Example 1: ####.####.####.

A period after each group of four digits must be entered.

Example 2: @???#-#

The matching tax number should contain a letter, followed by 3 letters or digits, then a single digit, then a dash, and a digit. No additional characters are allowed - not at the beginning, in the middle, or at the end of the tax code.