Credit Limit

WATCH THE VIDEO

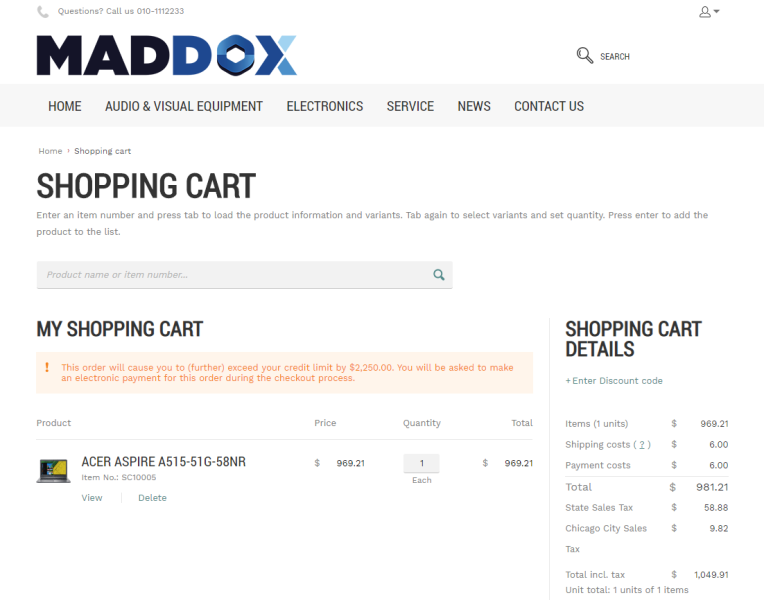

Different businesses might have their own credit management needs. In SAP you can set up automatic credit checks. Credit management allows you to reduce the credit risk by setting up the credit limit for your customers. If customers place an order which exceeds their credit limit set in SAP, customers will see a warning or error message in the shopping cart of the Sana webstore depending on the credit limit setup. A warning message is also shown on all checkout steps. A warning message is available in one step checkout and multistep checkout.

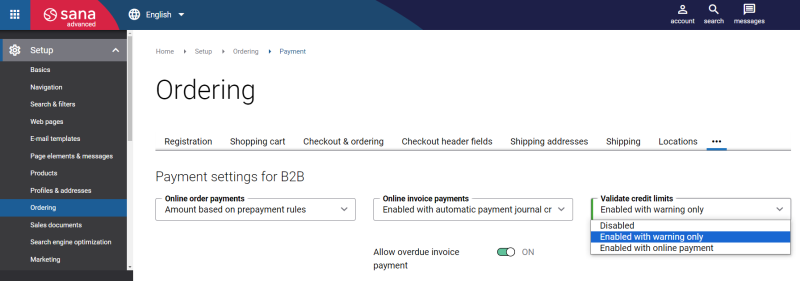

Credit limits must be set up in SAP and in Sana Admin (Setup > Ordering > Payment). For information about how to set up credit limits in Sana Admin, see Credit Limit.

In this article, you will learn how to set up credit limits in SAP.

Set Up Credit Limit Checks

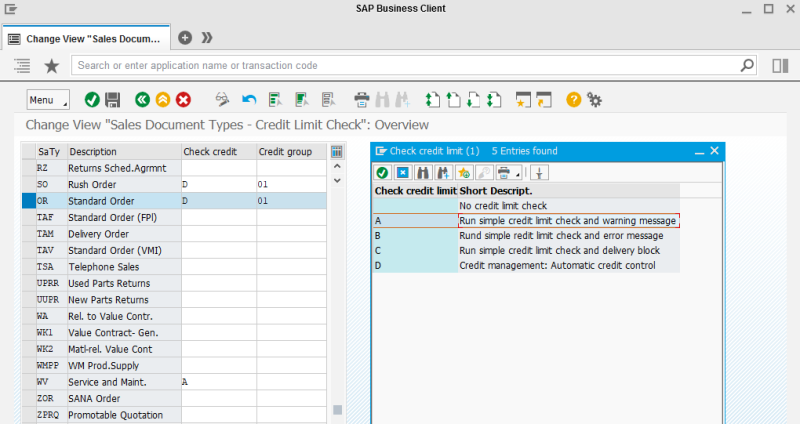

At first you need to set up credit limit checks for a sales document type (sales order) you are using. In SAP you can set up different sales document types for the Sana webstore. For more information, see Supported Order Types.

Step 1: Call the transaction OVAK (Sales Order Type Assignment).

Step 2: Find the sales document type (sales order) you are using for the Sana webstore and set up the appropriate credit limit check for it.

You can disable credit limit check and there are four standard checks in SAP.

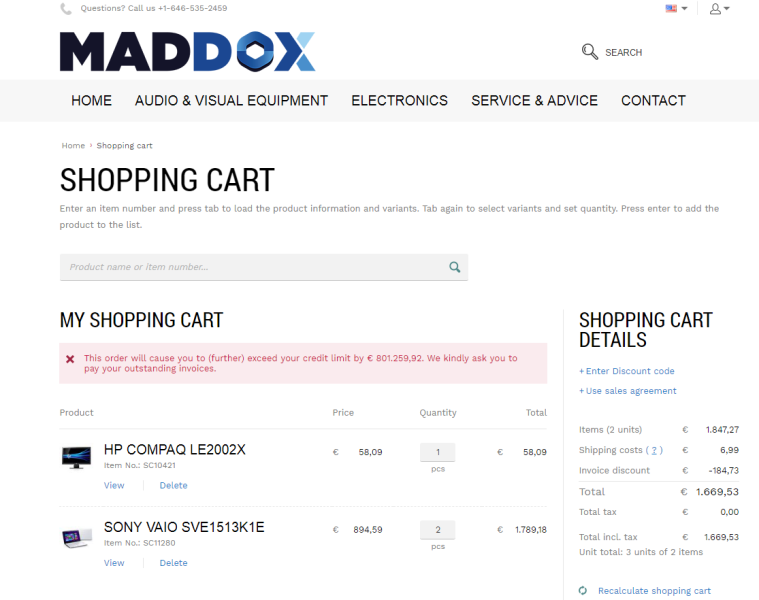

Using credit checks, A, C and D, customers will see a warning message in the shopping cart and on all checkout steps, if they exceed the credit limit. A warning does not block sales order creation unlike error, and a customer can place an order.

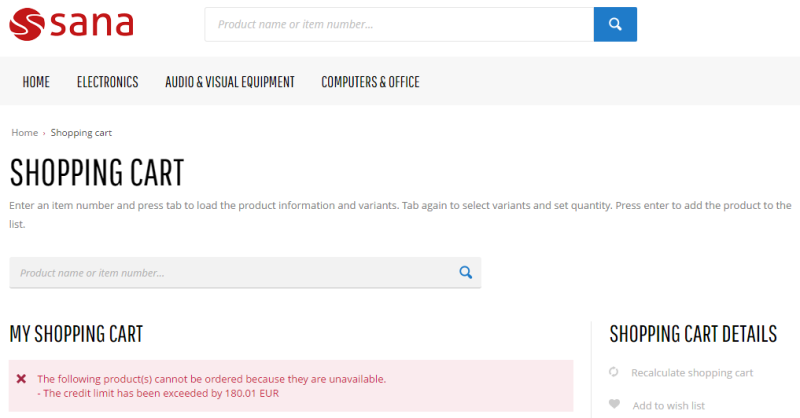

Using the credit check B, customers will see an error message in the shopping cart, if they exceed the credit limit. Customers will not be able to place an order, until they pay the invoices.

Set Up Credit Limit for a Customer

Step 1: Call the transaction FD32 (Customer Credit Management).

Step 2: Find the customer for whom the credit limit should be configured.

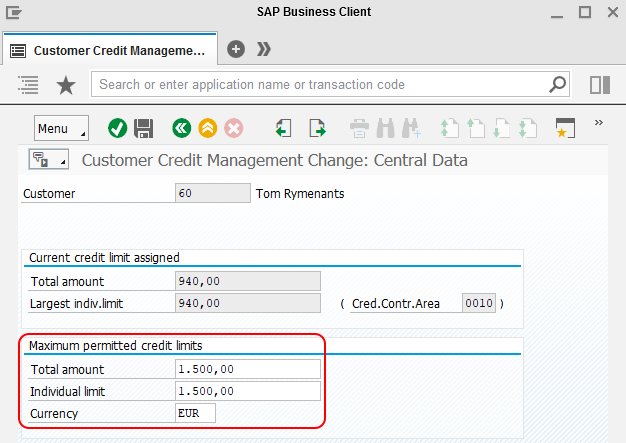

Step 3: In the Customer Credit Management Change: Central Data window, you can enter the overall credit limit the customer may receive in all credit control areas and the maximum credit limit the customer may receive within a credit control area.

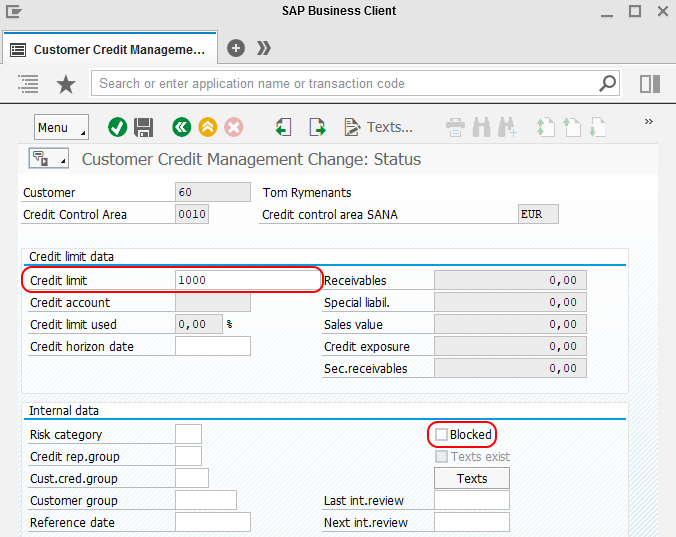

Step 4: In the Customer Credit Management Change: Status window, you can enter the upper limit for the total receivables.

If you select the checkbox Blocked, the customer will be blocked for all credit management business transactions. If customers exceed the credit limit, they will see an error message in the shopping cart. Customers will not be able to place an order, until they pay the invoices. This is another method that you can use to block certain customers from placing an order if they exceed a credit limit.