Taxes

WATCH THE VIDEO

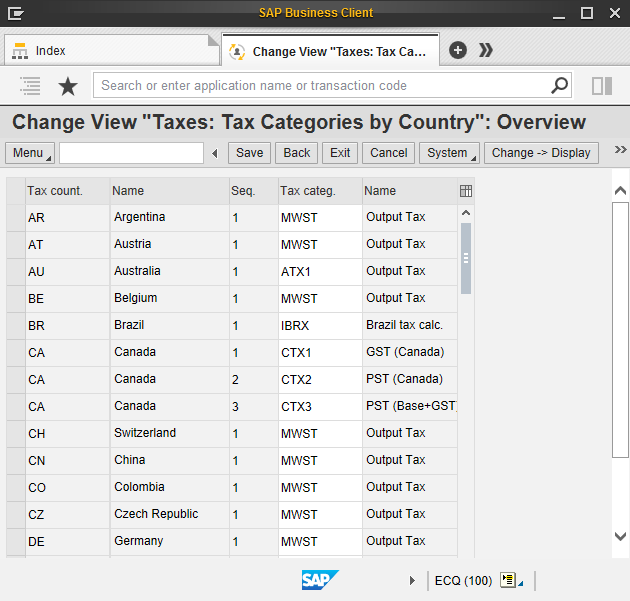

Every single country and even state has its own tax laws. They are so different that when people operate their online business they may contact their local authority on tax to ensure they are calculating tax properly for their webstore. Therefore, taxes are configured in SAP S/4HANA for each country (Taxes: Tax Categories by Country OVK1).

While managing customer or material master records in SAP S/4HANA, you can determine which are tax liable and which are tax exempted.

One of the common tax scenarios is whether to show prices to the customers including sales tax or excluding.

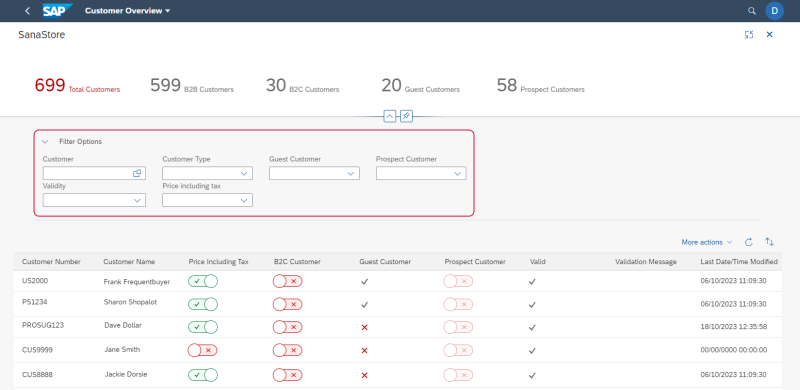

Step 1: Open the Customer Overview app in the SAP Fiori launchpad.

Step 2: Select your webstore and click Edit.

Step 3: Enable or disable the option Prices Including Tax to determine whether a customer should see product prices in the webstore including or excluding sales tax.

For more information, see Customer Overview.

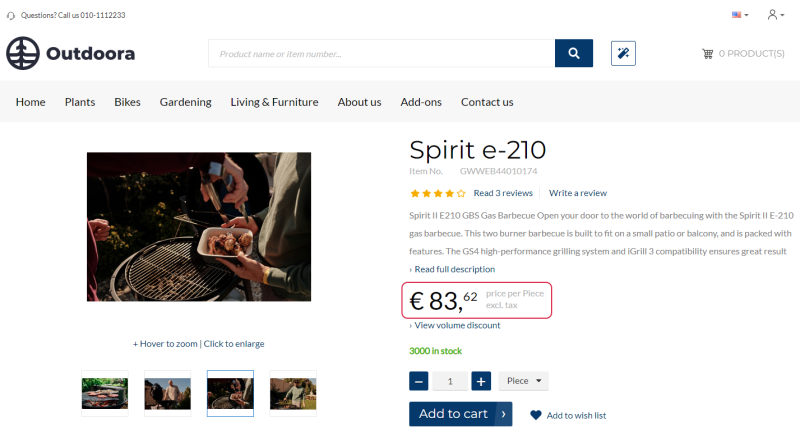

Customers can see whether a product price is shown including or excluding sales tax directly on the product details page. All taxes are also triggered during basket calculation and are shown to a customer in the shopping cart.

The incl.tax / excl.tax text is shown on the product details page using the UOM & tax indicator text content element.

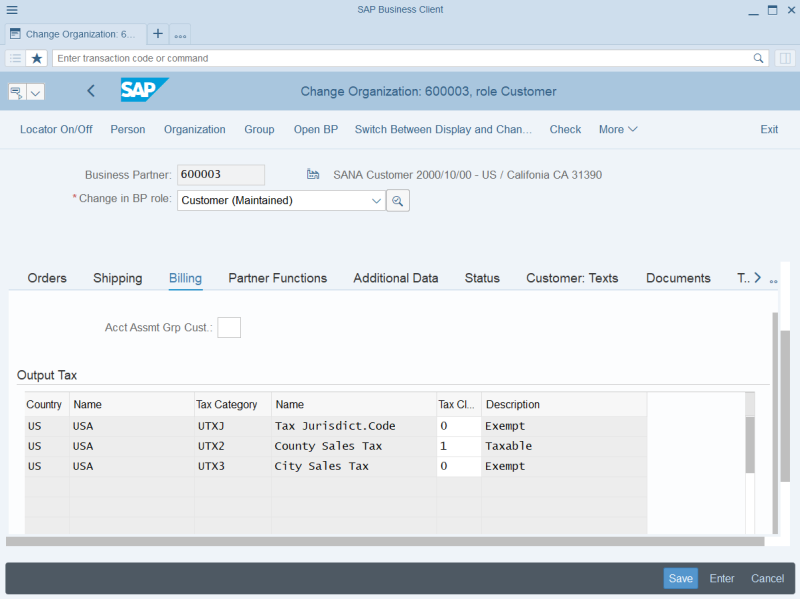

More tax settings can be set up in the Sales and Distribution area of the customer, on the Billing tab. There you can specify tax liability of the customer based on the customer's country to automatically determine country-specific taxes.

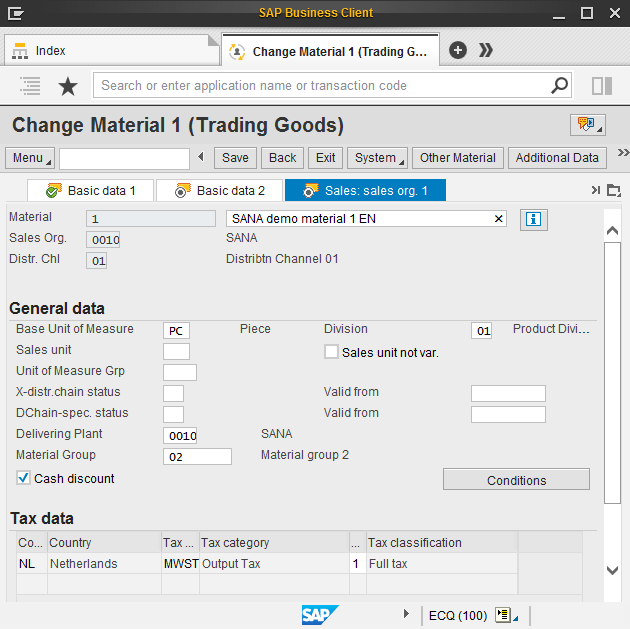

It is also possible to set up Tax data on the Sales org. 1 tab in the material master data. There you can specify whether or not taxes should apply to the item upon sale.

Different condition types can be used in SAP S/4HANA for tax calculations. You can also customize and use those condition types which are the most suitable for managing your business. For example, the MWST condition type is used for Output tax configuration. Using this condition type, you can configure domestic, export and also departure / destination country taxes.

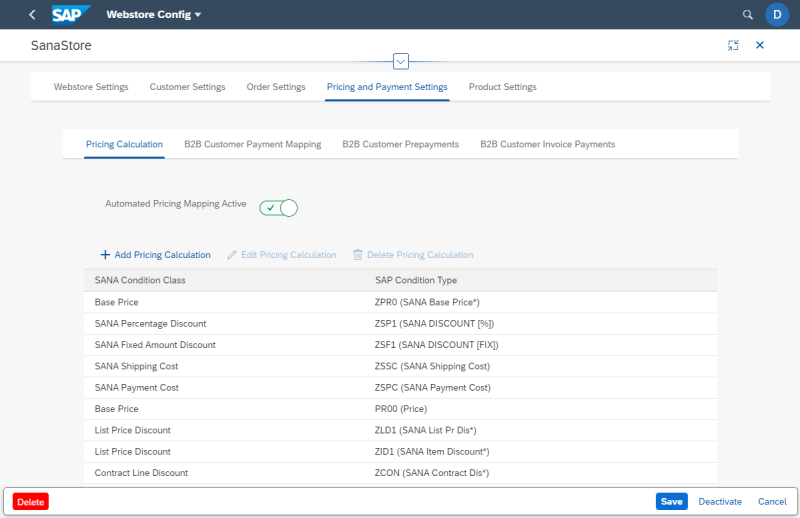

The condition type which should be used for tax calculations in the Sana webstore must be set up on the Pricing Calculation tab.

Step 1: Open the Webstore Configuration app in the SAP Fiori launchpad.

Step 2: Select your webstore and click Edit.

Step 3: Then, click: Pricing and Payment Settings > Pricing Calculation.

For more information, see Pricing Calculation.

Sales Tax per State or Region

If you are doing your business in the country which has states, you can set up states or regions for different countries which are used for customer registration. Also, you can set up sales taxes for each state or region. In this way, when a customer places an order in the webstore and selects the shipping address, the sales taxes will be calculated for the selected state or region.

Set Up States or Regions for Different Countries

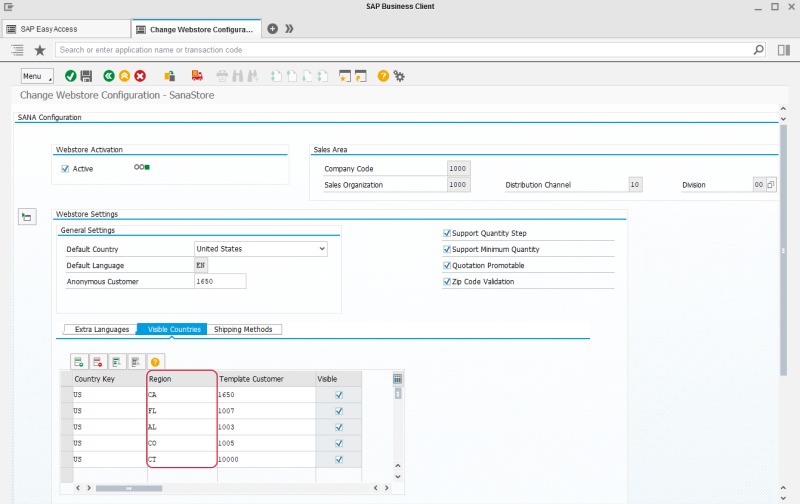

Step 1: In the main menu of the Sana add-on, click Webstore Configuration. In the Webstore Id field, select your webstore and click on the Change Webstore Settings button at the top. Expand the Webstore Settings area.

Step 2: In the Visible Countries table, add the states or regions which will be used for customer registration.

Set Up Sales Taxes for States or Regions

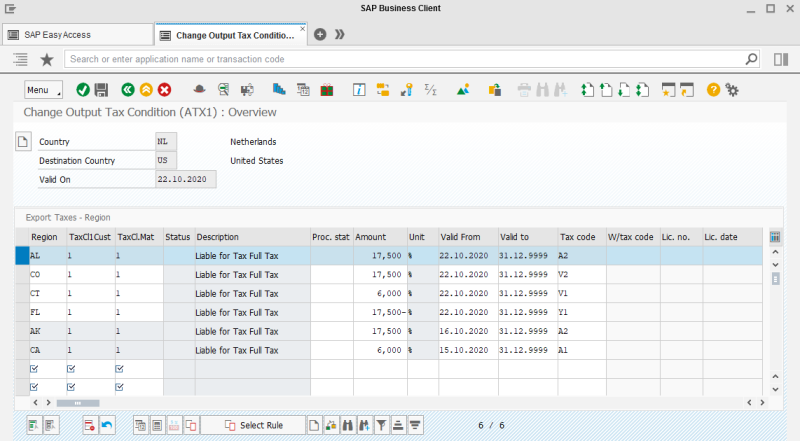

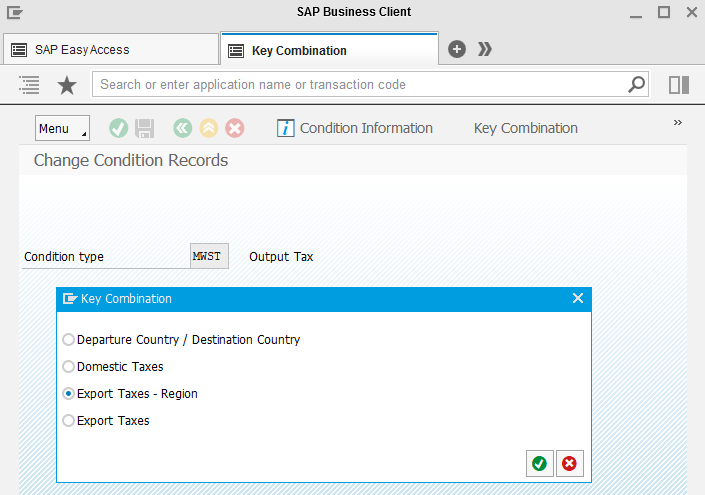

Step 1: To set up sales taxes for states or regions, use the Change Condition (VK12) transaction and the MWST condition type.

Step 2: Select the Export Taxes – Region option.

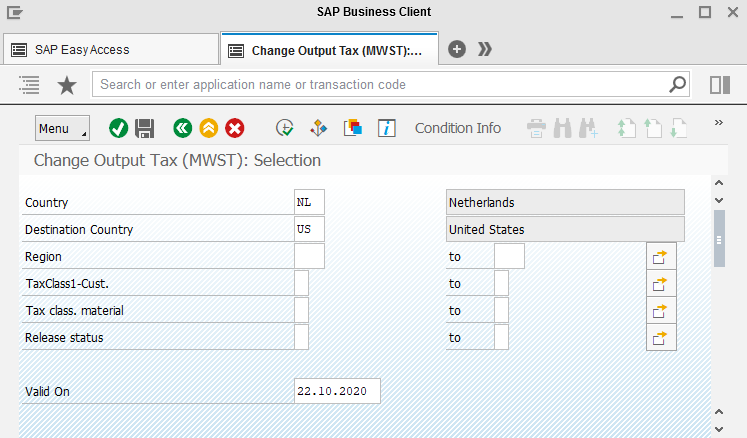

Step 3: In the Change Output Tax (MWST): Selection window, specify the departure country and country of destination and click Execute.

Step 4: Add the necessary states or regions to the table and set up the sales taxes for them.

When a customer registers in the Sana webstore online or places an order and chooses one of the available shipping addresses or enters another shipping address, sales taxes will be calculated for the selected state or region, if configured in SAP.