Auto Charges

Important: If you are considering migrating your ERP to Unified pricing management, please contact your Sana representative before making any changes. We want to ensure a smooth transition by working with you on an individualized plan tailored to your business needs.

Auto charges are used to apply any charges automatically to a sales order header or lines based on predefined rules and conditions. Auto charges in Unified pricing management are built upon the existing charges capabilities by introducing attribute-based charges. This enables businesses to set up rules to trigger specific charges automatically based on criteria like delivery mode, method of payment, product category, customer type, geographic region, etc.

Auto charges simplify and automate the process of adding extra costs to sales orders, helping to ensure pricing consistency and accuracy across different transactions.

Examples

A company sells products online and needs to apply shipping and handling charges based on the destination of the order.

-

Auto charge: An auto charge rule is created to apply a fixed shipping fee of $10 for domestic orders and $25 for international orders. The rule automatically calculates and adds the appropriate shipping charge to the sales order during checkout.

Scenario:

- Customer A in the U.S. places an order for $100 worth of products. The system automatically adds a $10 shipping charge.

- Customer B in Germany places an order for the same $100 worth of products. The system automatically adds a $25 shipping charge.

Configure Auto Charges

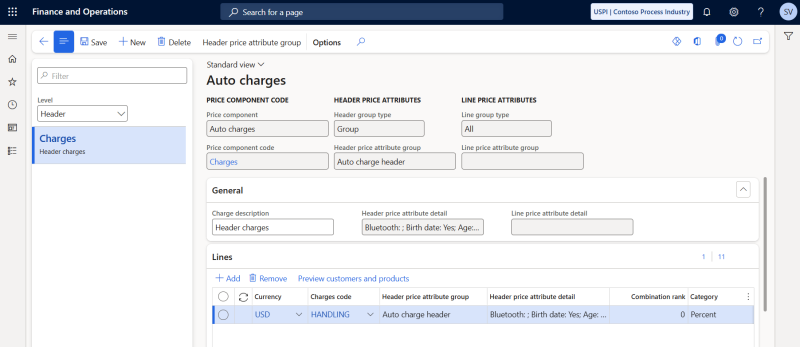

To set up auto charges, in Microsoft Dynamics 365 for Finance and Operations click: Pricing management > During-sales pricing > Charges setup > Auto charges.

Step 1: In the Level field, select the level to apply an auto charge to. Two options are available:

- Header: Apply charges to the order header.

- Line: Apply charges to the order lines.

Step 2: In the general area, in the Price component code field, select the price component code that the auto charge applies to.

Step 3: On the General FastTab, in the Charge description field, provide a description for the auto charge and click Save.

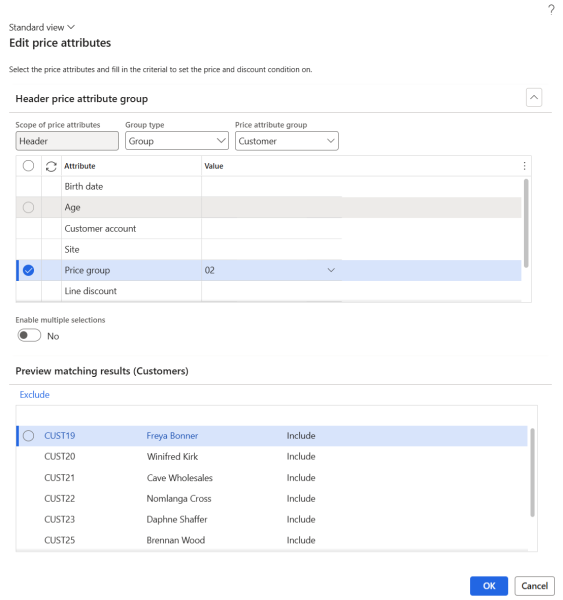

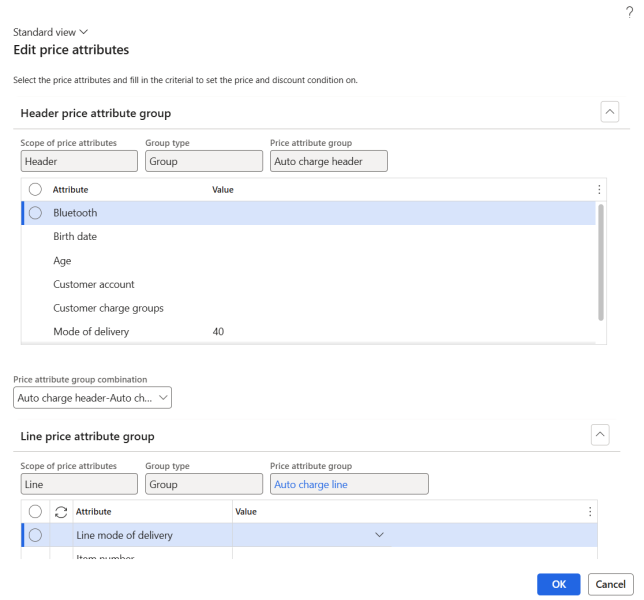

Step 4: In the header price attribute group settings, you can configure the customers to whom the auto charge will be applied. These settings can be accessed by selecting Header price attribute group on the Action Pane. The Edit price attributes dialog box appears, allowing you to configure the logic for identifying the customers to whom the auto charge will apply.

In the Group type field, choose the customer selection type you want to set up. The available options depend on the price attribute combinations associated with the selected price component code:

-

Group: By selecting this option, the dialog box will present a set of header attributes that you can assign values to, enabling you to narrow down the group of customers the pricing rule applies to.

-

All: The pricing rule will be applied to all customers.

If you selected the value Group in the Group type field, in the Price attribute group field choose a price attribute group. The available options depend on the attribute groups enabled for the selected price component code. The value you select will determine the set of attributes you can work with in the dialog box.

If you selected a price attribute group, its attributes will appear on the Header price attribute group FastTab. For each row, enter or select one or more values in the Value column to specify the rules for customer selection.

In the Preview matching results table, you can see a preview of the settings you have configured. The table will display a list of customers that meet the conditions you have configured.

Step 5: On the Lines FastTab, create the auto charge rule.

The table below provides description of the fields necessary to create an auto charge rule.

| Field | Description |

|---|---|

| Currency | Select the appropriate currency to ensure accurate billing and charge processing in the specified currency. |

| Charges code | Select one of the charges created in the Charges codes form. When a customer places an order in the Sana webshop and the auto charge is applied, the description of the appropriate charge code and charge value will be shown in the shopping cart. |

| Category | Select the method by which the charge should be calculated, for example fixed amount or percentage. |

| Charge value | The value for the charge category. |

| From amount | A starting amount of the order total to apply the auto charge to. |

| To amount | The ending amount of the order total to apply the auto charge to. |

| From date | The date when the auto charge becomes active and starts applying. |

| To date | The date when the auto charge ceases to be valid. |

| Sales tax group | The sales tax group associated with the charge. |

| Site | The site and warehouse associated with the charge. |

| Warehouse |

If you create auto charges for the Line level, you can edit the price attributes associated with the line using the Edit line price attribute button on the Lines FastTab.

Tiered Charges

From amount and To amount fields mean that you can setup tiered charges. It is possible to setup tiered charges only if auto charges are defined at the main level (order header) and the charge category is fixed or percentage.

For example, if you enter 1000$ in the From amount field and 5000$ in the To amount field, the auto charge will be applied to the sales orders with the total order amount in the range 1000$ - 5000$.

Since the system requires to calculate and compare the configured charges against the sales order total, this calculation is done by using the Tiered charges function on the sales order header, on the Sell tab. When you click Tiered charges on the sales order in Dynamics 365 for Finance and Operations, the applied tiered charge can be seen in the Charges transactions window by clicking Charges.

In Microsoft Dynamics 365 for Finance and Operations tiered charges are not supported for sales quotations. In case a customer creates a quotation in the Sana webshop and then converts it into a sales order, tiered charges will not be used as well.