Payments Lifecycle

Keep in mind that there is a limit on the amount per transaction. It is 150,000 euros or the equivalent in another currency. If the limit is exceeded, the payment transaction will be canceled.

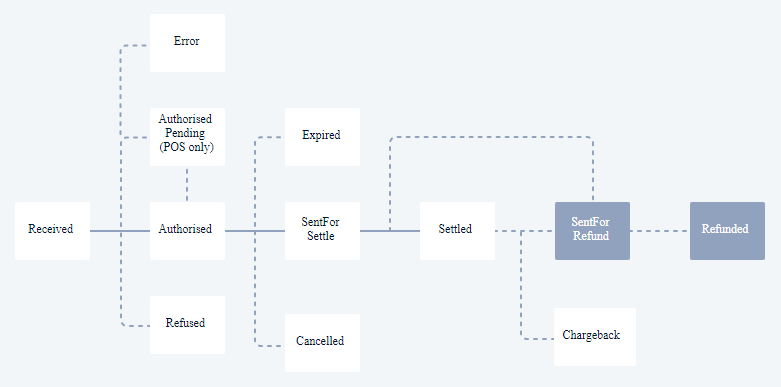

Regardless of the payment method, each payment goes through the same basic status sequence. The available payment statuses in the Customer Area are shown below.

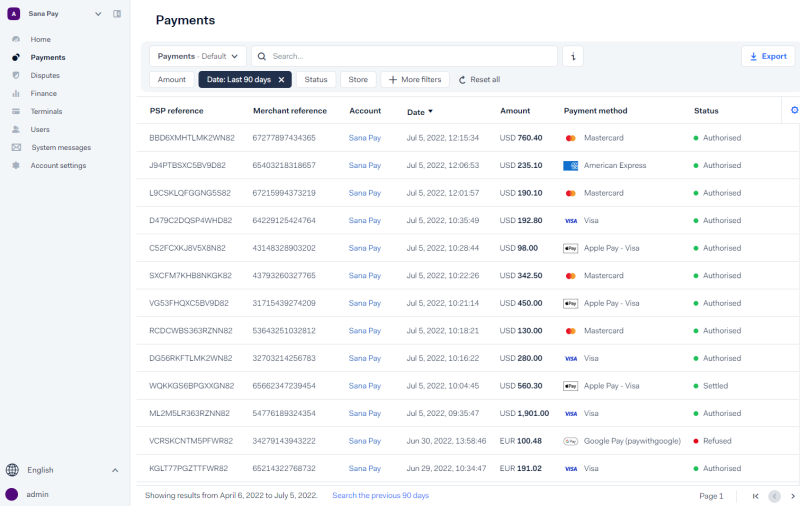

To check the payment status:

Step 1: Log in to your Customer Area.

Step 2: Go to: Payments.

Step 3: Check the Status column for the payment.

|

Payment status |

Description |

|---|---|

|

Received |

Registration of a validated payment attempt. This is the initial state for all payments. |

|

Authorised |

The payment is approved by the financial institution. This state serves as an indicator to proceed with the delivery of goods and services. |

|

SentForSettle |

The request for transferring the funds has been sent to the financial institution. NOTE

For some payment methods, the payment has to be captured before it can change its status to SentForSettle. When a payment reaches SentForSettle, it is no longer possible to cancel it, and you would need to refund it instead. |

|

SettleScheduled |

The net transaction amount will be paid out to you with a delay according to your Sales Day Payout schedule. NOTE

This status applies to Sales-Day Payout transactions only and appears in reports as Settled. |

|

Settled |

The financial institution has transferred the funds to Sana Pay. |

|

SentForRefund |

Your request to refund the payment back to the shopper has been sent to the financial institution. You can only refund a payment after it has reached SentForSettle. It is not possible to reverse a refund request. |

|

RefundScheduled |

The net transaction amount of the refund will be debited on your behalf with a delay according to your Sales Day Payout schedule. NOTE

This status applies to Sales-Day Payout transactions only. |

|

Refunded |

The financial institution has completed the reimbursement to the shopper. |

|

Refused |

The payment was declined by the financial institution. The payment is also refused if the fraud score exceeds 99 points. * This is a final state. |

|

Error |

A payment attempt was validated and received correctly, but an error occurred while communicating with the financial institution. The payment is assigned an error state. * This is a final state. |

|

Expired |

When an authorised payment is still open after 4 weeks, i.e. it has not been cancelled or captured, it is automatically set to Expired. When a payment reaches the Expired state, it is no longer possible to capture it. * This is a final state. |

|

Cancelled |

A cancellation blocks funds transfer for an authorised payment. It is possible to cancel a payment only if it has not yet reached the SentForSettle state. * This is a final state. |

|

AuthorisedPending |

The issuer approved the transaction online but we have not yet received confirmation from the payment terminal that the transaction is completed. From this status, the payment can go to the Authorised status or the Cancelled status. NOTE

This status applies to POS payments only. |

|

SettledBulk |

Credit Replaces SentForSettle and Settled. Applies to Visa and Mastercard transactions only. Displayed in:

|

|

RefundedBulk |

Debit Replaces SentForRefund and Refunded. Applies to Visa and Mastercard transactions only. Displayed in:

|

* A status is final if it does not allow transitioning to any other statuses within the process.

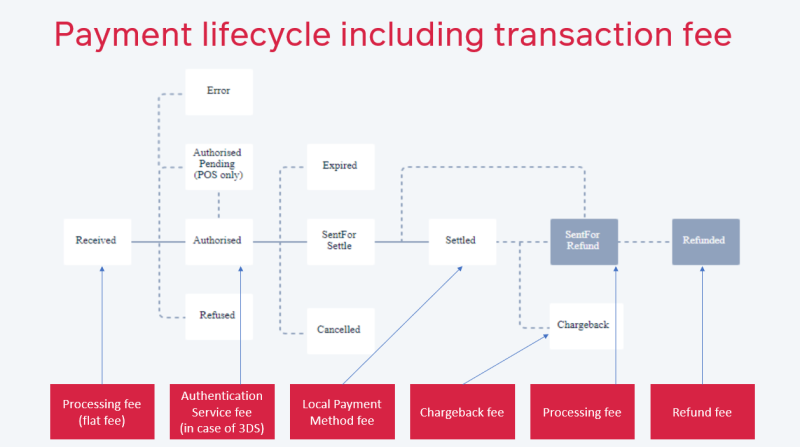

Payment Transaction Fees

When a customer pays for an order, the payment goes through different stages. Depending on the payment stage, different fees can apply.

- Received: Sana Pay processing fee is charged for each initiated transaction after clicking the Pay button in the checkout.

- Once the transaction is authorized, the 3DS (SCA) authentication fee is applied if enabled.

- Only after the transaction is settled, the local payment method fee will be applied as described in Sana Pay Pricing.

- In case of a chargeback, the chargeback fee applies according to the scheme.

- In case of a refund, a refund fee applies.

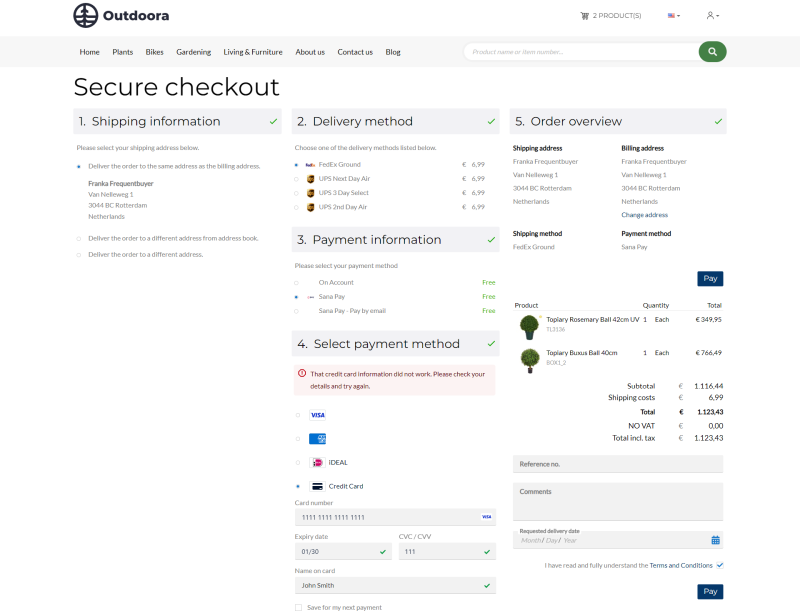

Payment Refusal

When a customer places an order and pays online through Sana Pay, the customer can see why the payment cannot be made if something goes wrong.

Payment can fail for several reasons:

-

Incorrect data: The customer enters incorrect payment information such as card number, expiration date, CVC, etc.

-

Insufficient funds: Not enough funds on the account of the entered card.

-

System error: Payment cannot be completed due to an unexpected error.

-

General reasons: Payment cannot be completed for other reasons, such as fraud protection.