VAT Posting Groups

Every company collects and pays taxes to various tax authorities. The rules and rates vary for countries, states, counties, and cities, and must be updated periodically as tax authorities change their requirements.

Configure VAT in Microsoft Dynamics NAV

VAT must be associated with both, VAT business posting group of a customer and VAT product posting group. VAT is calculated only for the VAT posting group codes that are included in both, VAT business posting group and VAT product posting group.

Step 1: In Microsoft Dynamics NAV click: Departments > Financial Management > Setup > VAT Posting Group. Configure VAT Business Posting Groups and VAT Product Posting Groups. In the VAT Posting Setup window, configure the combinations of VAT Business Posting Groups and VAT Product Posting Groups. For each combination, you should fill in a VAT percent. You can enter as many combinations as necessary.

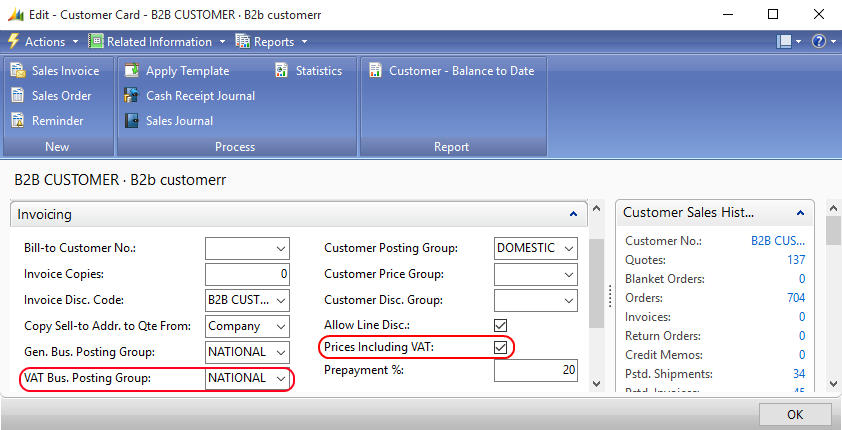

Step 2: Click: Departments > Sales & Marketing > Sales > Customers. Select the necessary customer and on the Invoicing FastTab, select the appropriate VAT Business Posting Group.

From the Customer Card, you can also control whether a customer should see prices including VAT or excluding. If you select the Prices Including VAT checkbox, on the Invoicing FastTab, a customer will see all product prices in the web store including VAT.

The incl.tax / excl.tax text is shown on the product details page using the UOM & tax indicator text content element.

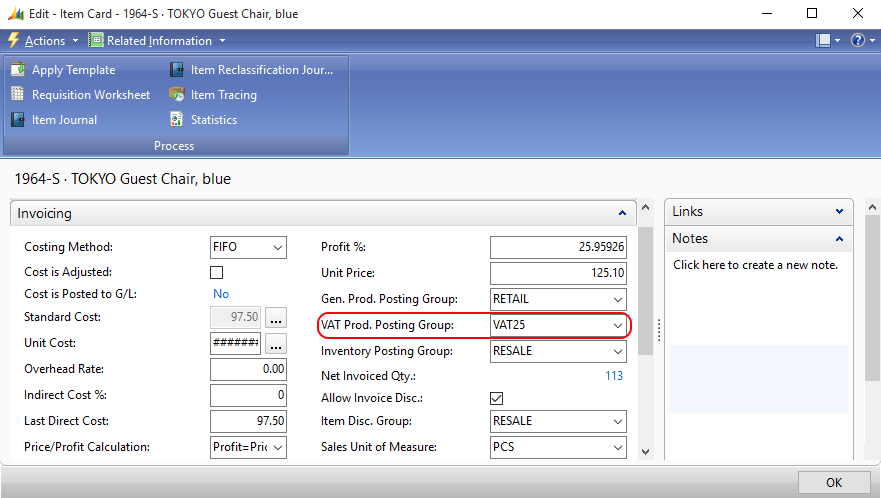

Step 3: Click: Departments > Sales & Marketing > Inventory & Pricing > Items. Select the necessary item and on the Invoicing FastTab, select the appropriate VAT Product Posting Group.

VAT is calculated when there is a match between the VAT posting group codes from the VAT Business Posting Group assigned to the customer and the VAT posting group codes from the VAT Product Posting Group assigned to the product. If there is no match, VAT will not be applied to the sales order.

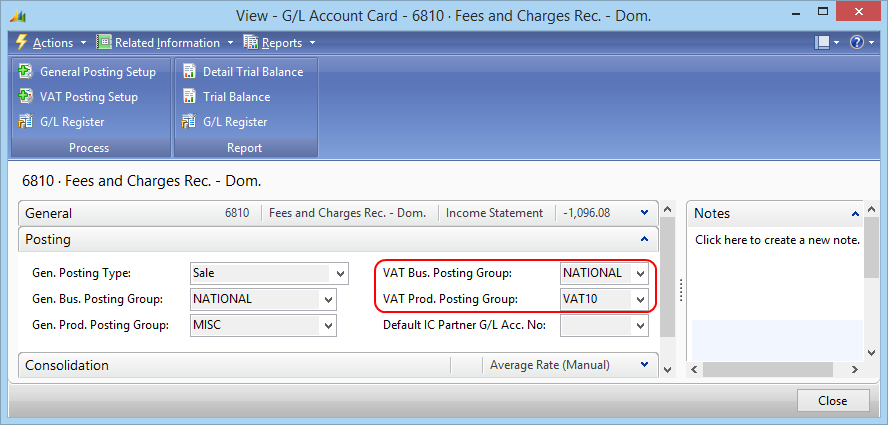

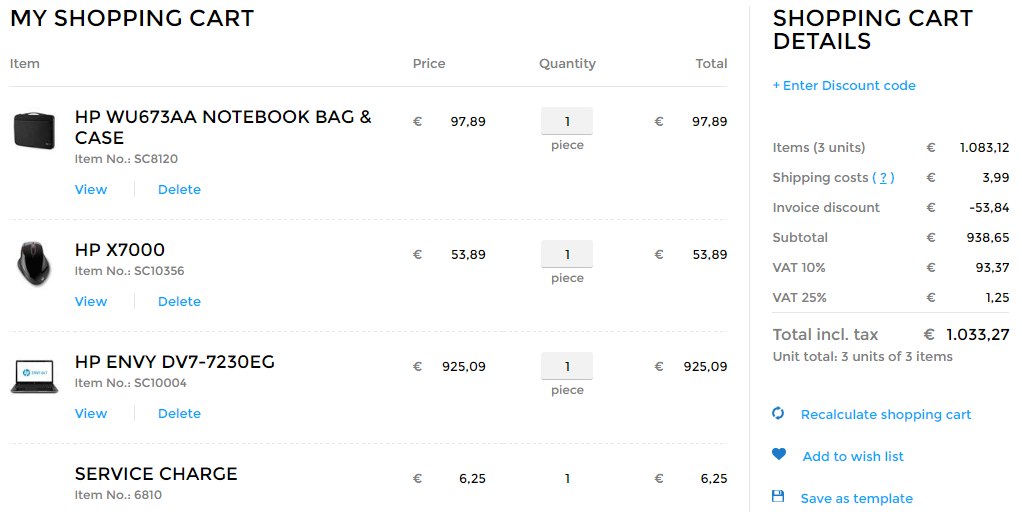

In Microsoft Dynamics NAV VAT is applied to each sales order line. Therefore, some extra taxes can be calculated. For example, if a service charge is applied to the sales order it is posted on a G/L account. G/L accounts in Microsoft Dynamics NAV can also store a combination of VAT Business Posting Group and VAT Product Posting Group.

If there is a relevant combination set for the G/L account, VAT will be applied to the corresponding sales order line.

VAT from Microsoft Dynamics NAV is triggered in the shopping cart of the Sana webstore.

In Sana Admin you can control presentation of taxes in the shopping cart of the Sana webstore. For more information about how to change presentation of sales taxes in the shopping cart, see Tax Presentation.