Item Sales Tax Group for Charges

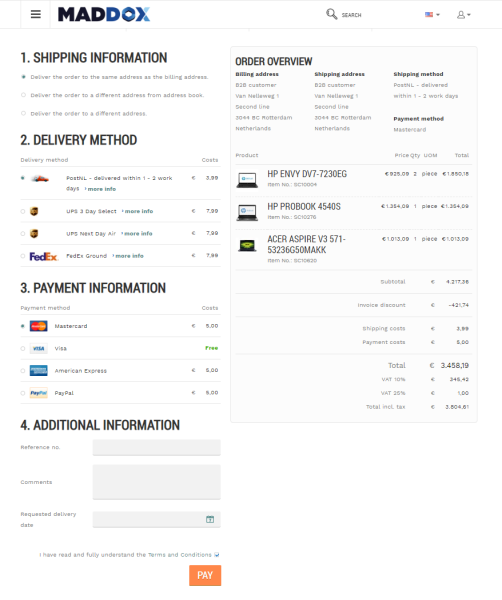

When customers create an order in the Sana webshop, they can select shipping and payment method.

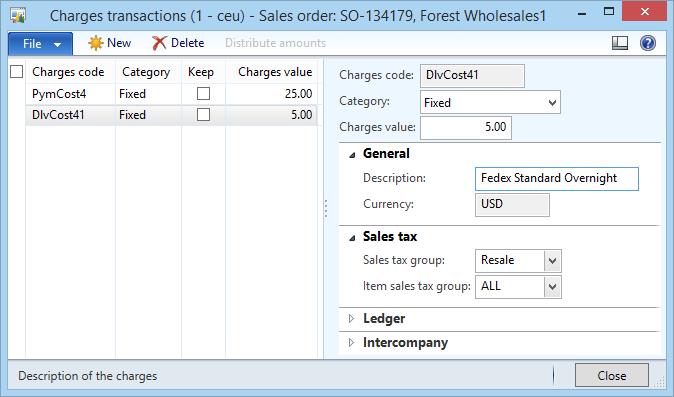

When a sales order is placed in the webshop, the selected shipping and payment methods with their costs are stored as charges in the related sales order in Microsoft Dynamics AX. When the first sales order with payment and shipping methods is placed, a new charge code will be created in Microsoft Dynamics AX.

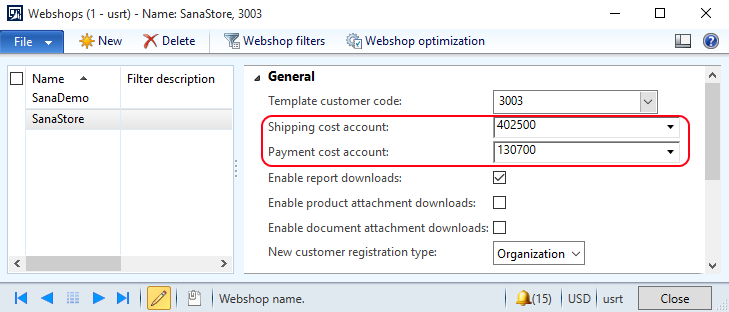

Shipping and payment costs coming from the webshop are booked on the G/L accounts set on the Webshops form.

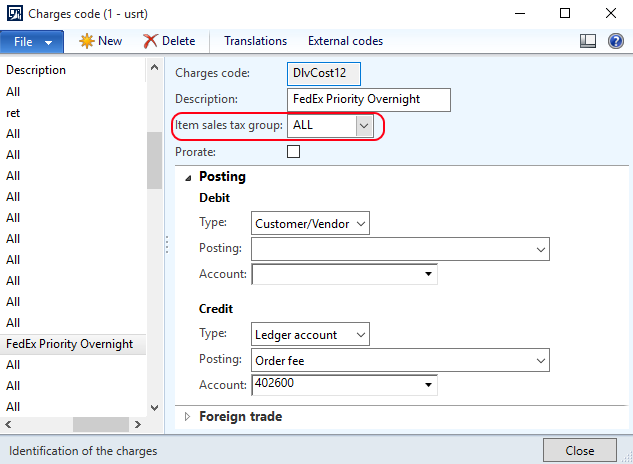

Microsoft Dynamics AX uses charges codes to apply charges to the sales orders. You can also set sales tax for the charges code.

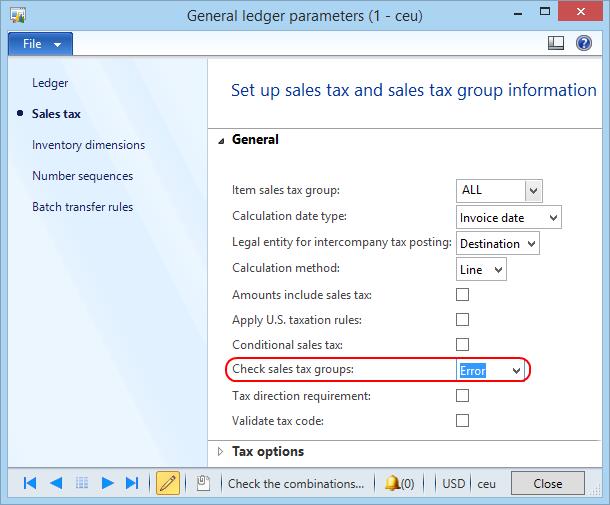

If in Microsoft Dynamics AX general ledger parameters it is configured to check sales tax group that is associated with the charges or products and it is not set, the sales order cannot be processed.

To set the item sales tax group for a charge, click: Accounts receivable > Setup > Charges > Charges code.

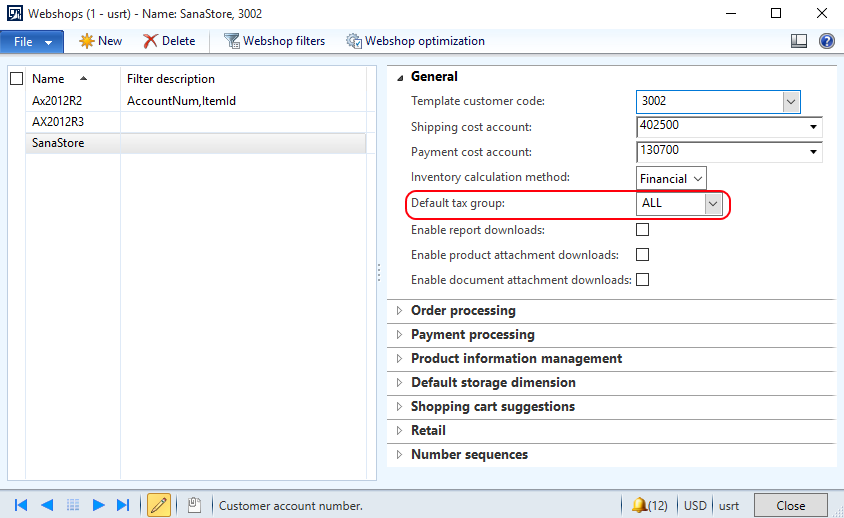

You can also set the default tax group on the Webshops form. In this case, when in the general ledger parameters it is configured to check sales tax group and it is not set for a charge code, the default one from the Webshops form will be used.

A product is not orderable if the item sales tax group is not set for a product.