Payment Reports

In the dynamic world of commerce, understanding the intricacies of financial transactions is essential for success. For merchants, payment reports are valuable insights. These reports, which compile a wealth of transactional data, give merchants a complete picture of their business's financial health and performance over a specified period. Let's explore why these reports are indispensable for merchants and how they can leverage them to drive growth and optimize operations.

-

Financial transparency allows tracking every penny and making sound financial decisions.

-

Analyze business performance to identify best-selling products, understand customer purchasing behavior, and identify trends or patterns that drive revenue growth.

-

Operational efficiency by accurately tracking and reconciling payments, automating financial processes, and identifying areas for improvement.

-

Valuable insights into customer preferences, spending habits, and demographics to deliver exceptional customer experience.

-

Detect unusual or suspicious transactions, identify potential chargebacks, comply with regulatory requirements, and proactively mitigate risks.

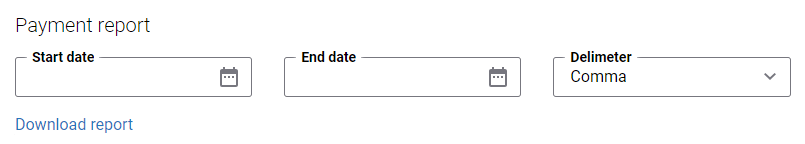

You can access a payment report for a specific period through the Sana Pay add-on configuration page in Sana Admin.

To receive accurate and up-to-date information about payment transactions, notification settings must be properly configured.

The payment report is available for download in the CSV format, and it contains the following details:

-

Order ID

-

Transaction ID

-

PSP reference

-

Type: payment, adjustment, capture, refund

-

Payment method

-

Amount

-

Remaining amount: to be captured or refunded

-

Currency

-

Invoice ID

-

Credit memo ID

-

Shopper reference

-

Shopper email

-

Success: True or False

-

Reason for failed transactions: for example, not enough balance, 3D not authenticated, expired card

-

Created: transaction creation date

-

Updated: transaction update date