OneClick Payments

Webstore visitors can store their credit card details, which can be used to initiate a one-click payment where the shop visitor only enters the CVC / CVV security code.

In the payment method settings, there is an option that allows you to enable and disable one-click payment.

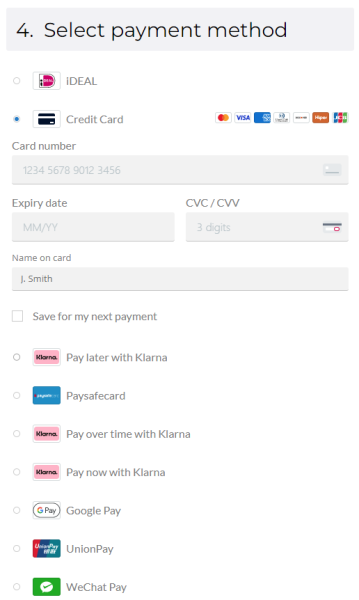

If the OneClick payment option is enabled, the Save for my next payment checkbox will be available on the Select payment method checkout step in the Sana web store. In this way, if the customer’s credit card data is saved, then the next time customers create an order in the Sana webstore and pay it through Sana Pay, they can use previously saved credit card information.

Customers need to pay at least one order through Sana Pay and on the Select payment method checkout step, they need to select the Save for my next payment checkbox to save the credit card information.

If the OneClick payment option is disabled, the Save for my next payment checkbox will not be available on the Select payment method checkout step in the Sana webstore. Customer will not be able to save their credit card information and will have to enter it manually every time they create an order in the webstore and pay it through Sana Pay.

Good to Know

- All cards are linked to the customer ID. Since several shop accounts can be linked to the same customer in ERP, we strongly recommend not to do this.

- If you allow guests to place orders without registration in your web store, for security reasons we do not recommend to allow guests to save their credit card information. To avoid it, you can create separate payment methods for different types of customers, for example, with the enabled OneClick payment option for B2C and B2B customers and disabled for guests. Then, you can create one customer segment for guests and another for B2C and B2B customers and assign them to the appropriate payment methods.

- One-click payments are also supported by the ACH Direct Debit payment method. This means that customers can store their ACH Direct Debit bank accounts for future use. Customers can store multiple ACH Direct Debit bank accounts, but they cannot distinguish between them because they do not have a number like credit cards.