Avalara Tax Rates by Address

In SAP Business One 10.0 FP 2202 Hotfix 1 and FP 2208, SAP introduced Avalara tax rates by address, allowing customers to receive sales tax from Avalara. It is available only in the United States localization. Please note that tax rates by address from Avalara for SAP Business One is a limited offering from Avalara, but not Avalara AvaTax.

With this Sana Commerce Cloud release for SAP Business One, Sana also support this functionality. For more information, see Avalara Tax Rates by Address.

Avalara is a market-leading service provider that helps businesses of all sizes achieve automated tax compliance.

It is possible to connect SAP Business One to Avalara and use it as a source of up-to-date tax information. If you do this, taxes calculated by Avalara will be shown to your customers in the shopping cart of the Sana webstore. When a customer adds some products to the shopping cart in the Sana webstore, Avalara calculates sales tax in real-time based on the customer’s address and returns it to Sana.

This is new functionality in SAP Business One that gets tax rates from Avalara in real time based on the customer’s address. Therefore, we strongly recommend that you test it before use and make sure that everything works as you expect.

If you want to use this functionality, the setup should be done in collaboration with your SAP partner and Avalara. Sana only displays the sales tax calculated by Avalara.

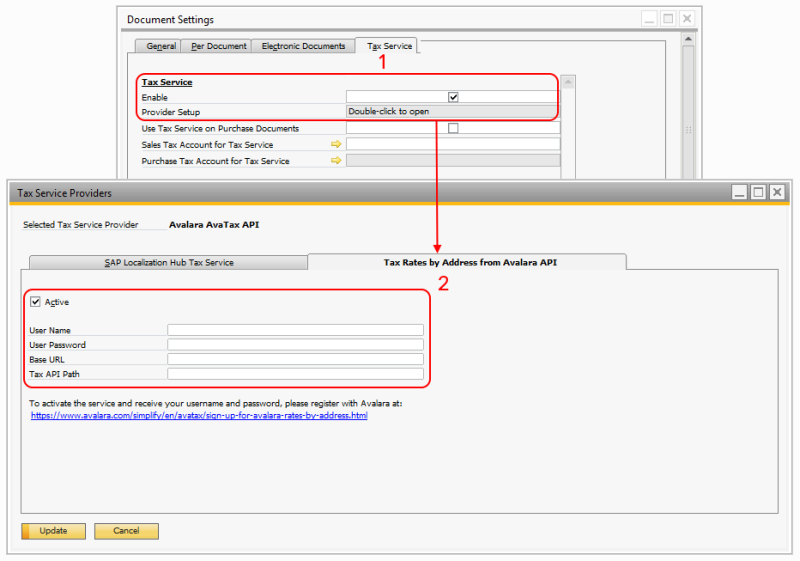

For more information, see Sign up for Avalara Rates by Address and Tax Service.