Online Invoice Payments

WATCH THE VIDEO

Sana Commerce Cloud allows business customers to pay outstanding invoices through a payment provider directly from a web store. Business customers can pay multiple outstanding invoices at the same time. Online payments of the open invoices from a Sana web store are seamlessly integrated with the Sales, Financials, and Banking modules of SAP Business One. For more information about how to pay invoices from a Sana web store and online invoice payments setup, see Online Invoice Payments.

Set Up G/L Account

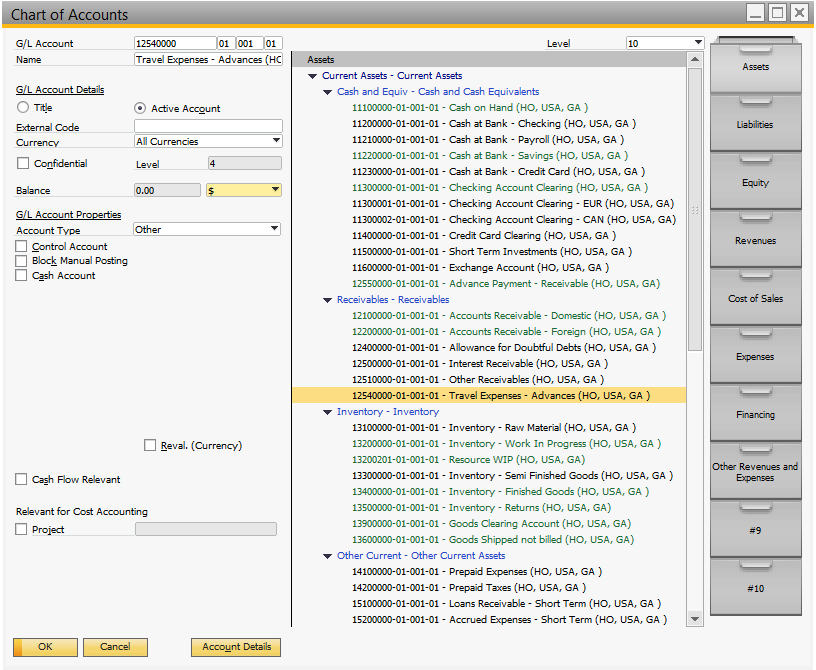

To allow business customers to pay their outstanding invoices, you must set up a G/L account for your Sana web store in SAP Business One.

All incoming payments of the customers' invoices are posted to the G/L account. For more information, read the official SAP Business One documentation Chart of Accounts.

Step 1: In SAP Business One set up the G/L account at the following location: Financials > Chart of Accounts.

Step 2: Go to: Web Store > Web Stores. On the Payment Processing tab, enter the relevant G/L Account No (Code) for your web store. All invoice payments from your customers will be registered on this G/L account.

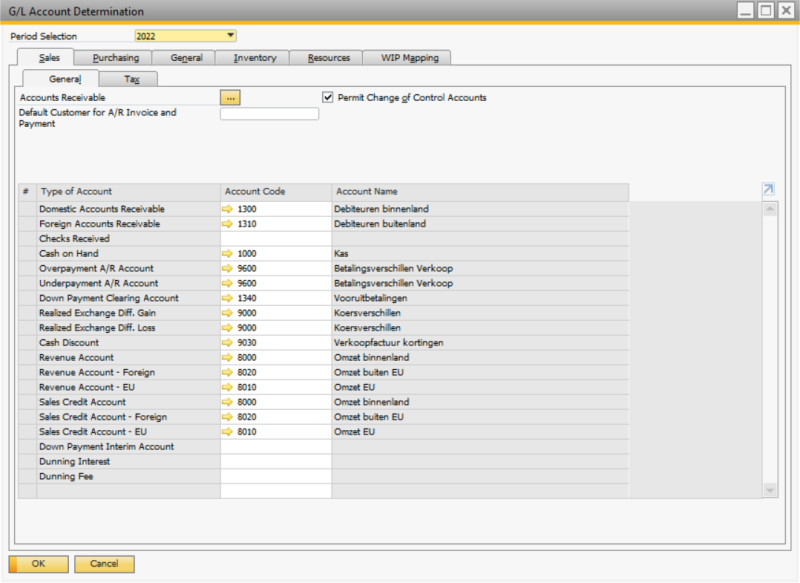

If you do not specify the G/L account in the G/L Account No field in the web store settings, then the default G/L account will be used for the invoice payments. In SAP Business One click: Administration > Setup > Financials > G/L Account Determination. On the Sales > General tab, you can set the default G/L account for the invoice payments.

How Incoming Invoice Payments Are Processed in SAP Business One

When customers pay their invoice from the Sana web store, a payment draft report for the incoming invoice payment or a direct incoming invoice payment will be created in SAP Business One. It depends on the option you select in the Post Incoming Payment field in the web store settings.

- If you select Yes, when customers pay their invoice from the Sana web store, a direct incoming invoice payment will be created in SAP Business One. The invoice status in the Sana web store will change to Already paid.

- If you select Draft Only, when customers pay their invoice from the Sana web store, a payment draft report for the incoming invoice payment will be created in SAP Business One. The invoice status in the Sana web store will change to Your payment is being processed.

How Incoming Invoice Payment Drafts Are Processed in SAP Business One

In this article, you will learn how online invoice payments from the Sana web store are processed in SAP Business One when the option Draft Only is selected in the Post Incoming Payment field.

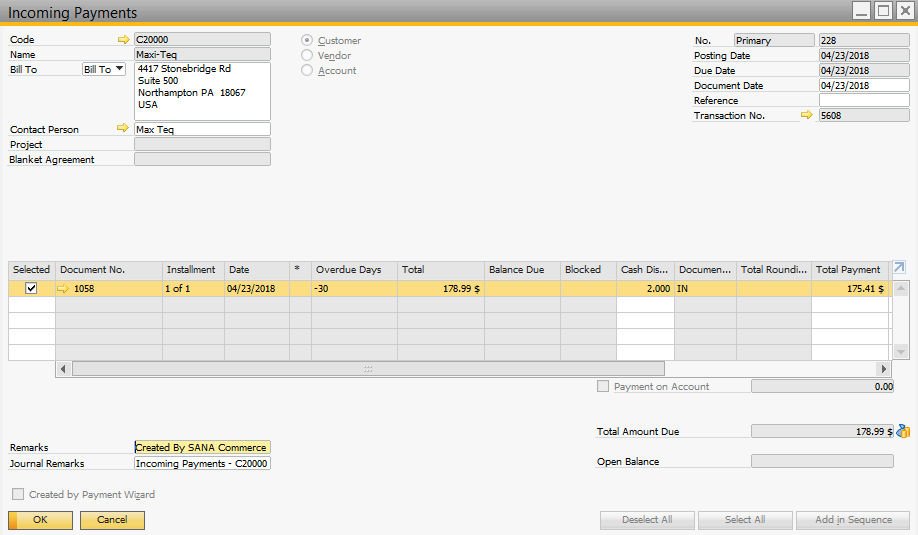

When customers pay their invoice from the Sana web store, a payment draft report for the incoming invoice payment will be created in SAP Business One. The invoice status in the Sana web store will change to Your payment is being processed.

Step 1: To see payment draft reports, in SAP Business One click: Banking > Banking Reports > Payment Drafts Report.

In the Payment Drafts Report window, you can see all incoming invoice payments. If you have several web stores, in the Web Store field, you can see from which web store the invoice has been paid.

Step 2: Double-click on the payment draft report to open the incoming (invoice) payments draft.

Disable Payment on Account and then click on the icon  next to the Total Amount Due field.

next to the Total Amount Due field.

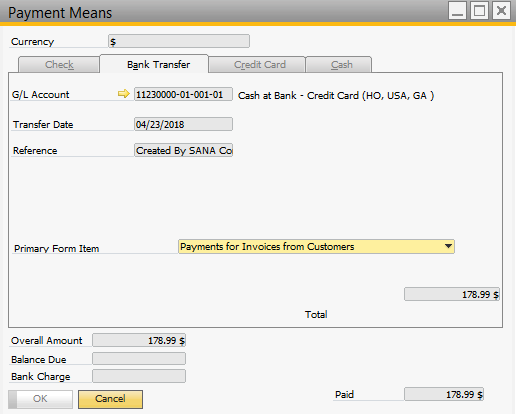

An accountant must create an incoming (invoice) payment document for one of the following payment means:

- Check

- Bank Transfer

- Credit Card

- Cash

Step 3: Create the incoming payment for the invoice. When it is created, the status of the invoice in the Sana web store will change to Already paid.

You can also check the G/L account on which the invoice payment was registered. On the toolbar, click on the Payment Means button.

If you allow your business customers to pay their invoices with automatic payment journal creation, then when a customer pays the invoice, the incoming payment draft will be created automatically in SAP Business One, and the payment will be registered on the required G/L account set in the web store settings. An account must create an incoming payment document from the draft for one of the available payment means.

If you allow your business customers to pay their invoices with manual payment journal creation, then when a customer pays the invoice, an accountant should manually handle such payments and create an incoming payment record in SAP Business One.

How Direct Incoming Invoice Payments Are Processed in SAP Business One

In this article, you will learn how online invoice payments from the Sana web store are processed in SAP Business One when the option Yes is selected in the Post Incoming Payment field.

When customers pay their invoice from the Sana web store, a direct incoming invoice payment is created in SAP Business One. The invoice status in the Sana web store will change to Already paid. You will not be able to edit the incoming payment as it will automatically create a journal entry in SAP Business One.

For direct incoming payments, the cash payment means will be created in SAP Business One. A direct incoming payment can only be cancelled by a Credit Note in SAP Business One.

When using direct incoming invoice payment, it is recommended to enable the option Include Cash Discount. Otherwise, the incoming payment will have an open balance equal to the cash discount in SAP Business One.

Payment Reference

A payment reference is a piece of information that is used to easily identify a payment transaction. There are three components – the Sana webstore, your SAP Business One system, and the payment service provider that you use to accept online payments from your customers. When a customer creates an order and pays an invoice online in the Sana web store, the order will be saved to SAP Business One and the payment transaction will be created in the payment system you use for online payments. To find the required payment transaction in your payment system, you need some information, such as the payment transaction ID.

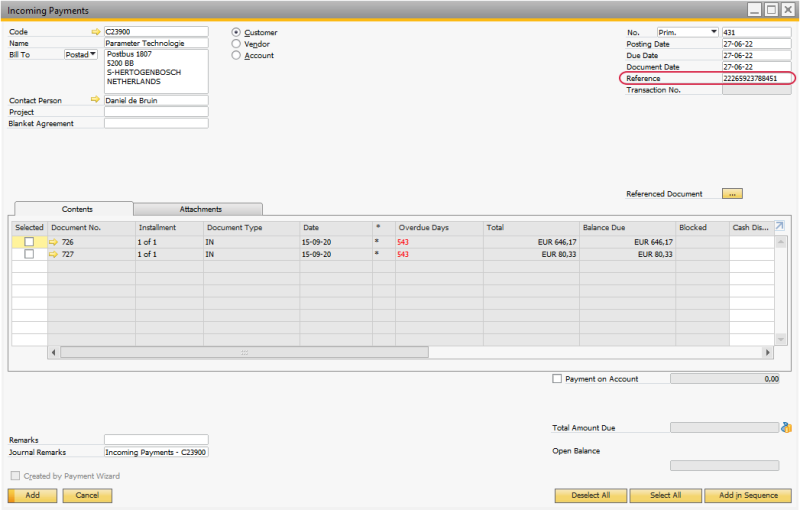

When a customer pays an invoice online in the web store, the payment transaction ID of the sales order is stored in the incoming payment in SAP Business One.

Cash Discount

Cash discounts are used to encourage customers to settle their debts as soon as possible. It can be granted when customers pay their invoice prior to the due date.

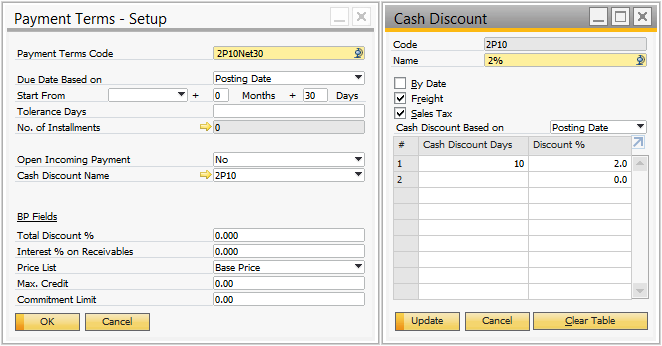

You can set up cash discount in the Payment Terms of the Business Partner Master Data. For more information, read the official SAP Business One documentation How to Define Cash Discounts.

If you set up cash discounts for your business partners and want to show the invoice amount with the discount in the Sana web store, then go to: Web Store > Web Stores. On the Payment Processing tab, enable the option Include Cash Discount for your web store.

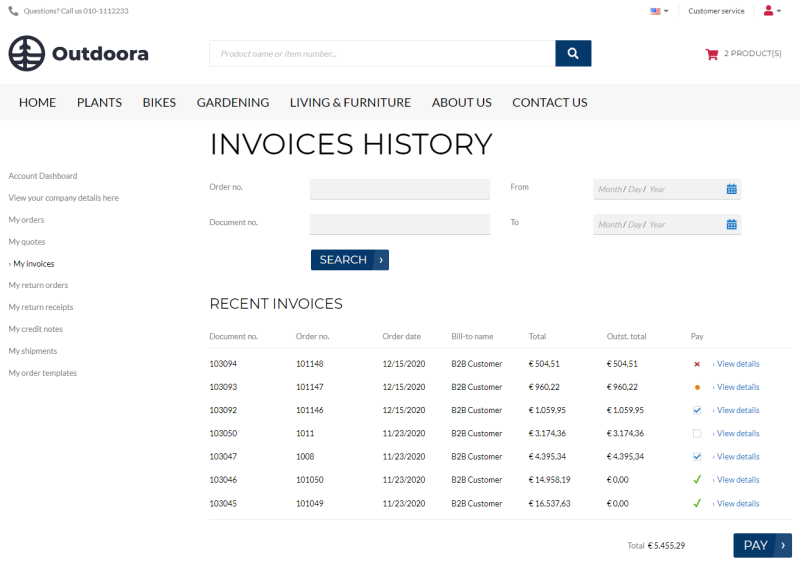

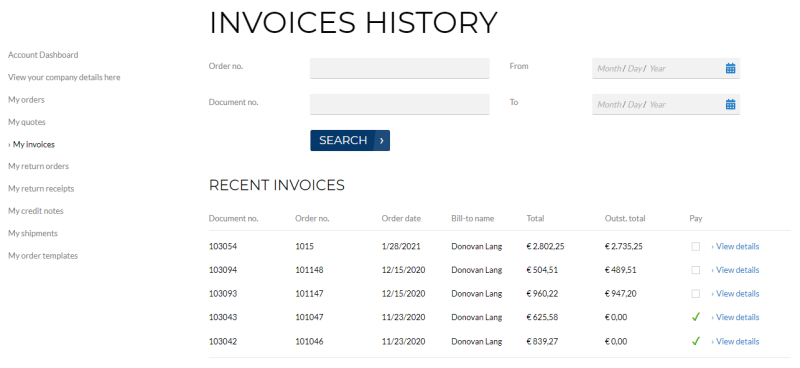

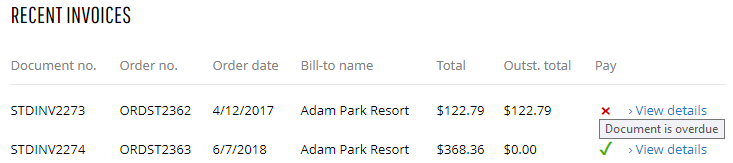

If the cash discount is calculated for the invoice, the customer will see two different invoice amounts in the invoices history - the total amount without the cash discount and the outstanding total amount with the cash discount.

Due Date

An invoice can have a due date in SAP Business One. It is calculated based on the payment terms set in Business Partner Master Data, on the Payment Terms tab.

If the invoice is not paid within the due date, it will expire. The status of this invoice will change to Document is overdue in the invoice history in the web store.

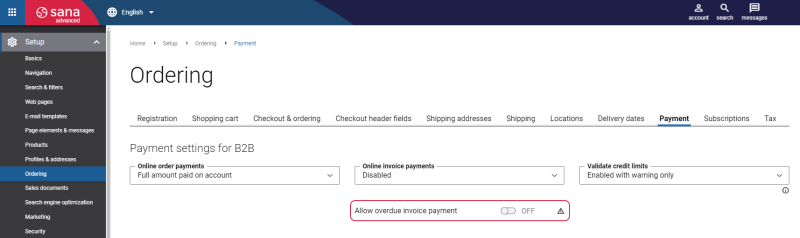

You can decide whether or not customers should be able to pay overdue invoices in the Sana web store. To do this, in Sana Admin click: Setup > Ordering > Payment. Use the Allow overdue invoice payment option.